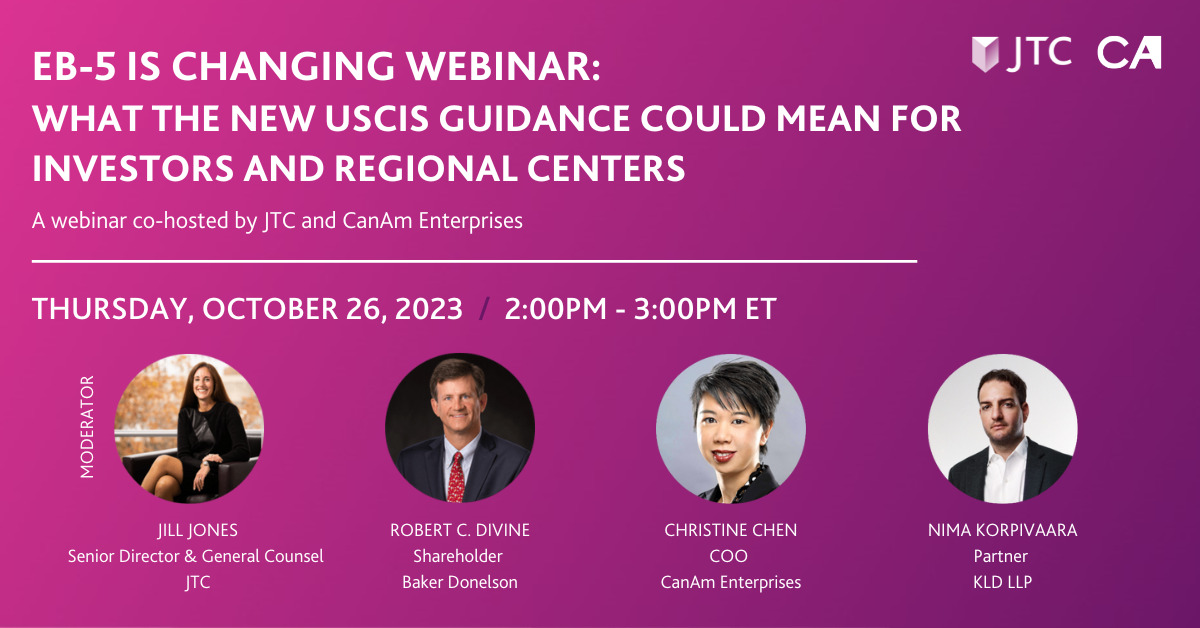

The EB-5 Immigrant Investor Program has long been a pathway for international investors to gain U.S. residency while contributing to job creation and economic growth. However, selecting the right EB-5 project is critical, as it directly impacts both immigration and financial outcomes. In a recent webinar hosted by JTC Group and CanAm Enterprises, industry experts provided in-depth insights on the due diligence process that investors should follow to mitigate risks and maximize their chances of success.

The Importance of EB-5 Investment Due Diligence

As EB-5 investor demand increases, so does the complexity of assessing project viability. Due diligence is not just about selecting a promising project; it involves verifying the financial stability of the developer, ensuring job creation requirements will be met, and understanding exit strategies. Investors must consider multiple factors to ensure their chosen project aligns with both immigration and financial goals.

Joey Barnett, an immigration attorney at Wolfsdorf Rosenthal LLP, highlighted the dual nature of EB-5: “To many immigrant investors, it’s a green card program because it allows you and your family to remain in the United States forever. But it’s also a job creation and investment program.” This underscores the need for investors to balance immigration considerations with sound financial decision-making.

Key Factors to Evaluate in an EB-5 Investment

-

Project Sponsorship and Track Record

Understanding who is behind the project is crucial. A strong regional center and experienced developer provide stability and a track record of successful project completion.

- Has the regional center successfully sponsored past EB-5 projects?

- What is the developer’s track record in delivering projects on time and within budget?

- Does the project have the necessary permits and approvals in place?

Sebastian Stubbe, CEO of Pine State Regional Center, emphasized that “experience and conservative financial structuring are key indicators of a project’s likelihood of success.”

-

Project Financing and Capital Stack

A well-structured capital stack indicates a developer’s commitment to the project and reduces risk for investors.

- Is the project fully financed?

- How much developer equity is invested?

- Are there institutional-grade equity investors involved?

Walter Gindin, General Counsel at CanAm, noted that strong capital stacks with meaningful developer equity contributions demonstrate long-term commitment and reduce the risk of default.

-

Job Creation Methodology

Job creation is the cornerstone of EB-5 eligibility. Investors should scrutinize how jobs will be counted and whether the project has a realistic job creation plan.

- What methodology is being used for job creation calculations?

- Will jobs be created early in the project to provide immigration security?

- Has the economic model been reviewed by experienced professionals?

Suzanne Lazicki, President of Lucid Professional Writing, pointed out that many denials stem from projects failing to create jobs as expected. “The most common reason for project-related denials is that the project never got started. Investors should ensure that spending plans align with job creation requirements.”

-

Exit Strategy and Investment Security

While EB-5 does not guarantee capital return, investors must assess exit strategies to gauge the likelihood of repayment.

- What is the project’s expected hold period for EB-5 funds?

- Are there mechanisms to protect investors in case of delays?

- Does the business model support a viable exit strategy?

Stubbe warned against high-return promises, stating, “If the return is too high, it likely signals hidden risks. Institutional-grade projects prioritize stability over speculative profits.”

Mitigating Risk with Third-Party Oversight

With the EB-5 Reform and Integrity Act of 2022, third-party oversight has become a crucial factor in reducing fraud and ensuring transparency.

With the EB-5 Reform and Integrity Act of 2022, third-party oversight has become a crucial factor in reducing fraud and ensuring transparency.

- Fund Administrators: Ensure that investor funds are properly managed and deployed for job creation.

- Third-Party Audits: Independent reviews of financials and compliance add an additional layer of protection.

- Investor Reporting: Regular updates on project progress allow investors to track milestones and job creation.

Jill Jones, General Counsel at JTC, noted that “fund administrators now co-sign disbursements, ensuring transparency and providing investors with confidence that their money is being used as intended.”

Conclusion: The Power of Informed Decision-Making

The success of an EB-5 investment hinges on thorough due diligence. Investors should work with experienced legal and financial professionals to evaluate project feasibility, job creation potential, and financial security. As Christine Chen, COO of CanAm Enterprises, summarized, “EB-5 is not just about buying a green card. It’s about making a real investment in America’s future.”

For investors looking to navigate the complexities of EB-5, understanding key due diligence considerations is the first step toward a successful immigration and financial outcome.

Dive Deeper Into EB-5: