These days, it is relatively simple to buy and sell stock or mutual funds with a few clicks from your computer or mobile device. However, investors who want to invest in certain private securities offerings must meet certain prerequisites. Private equity real estate funds are among those that are only available to “accredited” investors. So, how do you qualify to be considered an accredited investor, and why is it necessary?

First of all, the U.S. government has a number of federal laws aimed at protecting the “little guy.” Those laws span a variety of activities ranging from buying a car and applying for a bank loan to making financial investments. Federal securities laws that were introduced in the 1930s require an individual to be qualified as an accredited investor in order to participate in certain private fund offerings, such as hedge funds, venture capital funds or real estate crowdfunding, among others. The reasoning behind those laws is to protect less sophisticated investors from making bad financial decisions. Whereas publicly traded companies, such as Microsoft or Google, are required by the U.S. Securities and Exchange Commission (SEC) to disclose certain information to investors, certain private securities offerings are not required to make the same disclosures and are therefore viewed as riskier.

How do I qualify as an accredited investor?

There are three ways for an individual investor to be accredited: income, net worth or professional knowledge/credentials. Based on new rule modifications that went into effect in December 2020, an individual (normal investor) can qualify if he or she meets one of the below criteria:

Earns income that exceeded $200,000 (or $300,000 together with a spouse or spousal equivalent) in each of the prior two years, and reasonably expects the same for the current year, OR

Has a net worth over $1 million, either alone or together with a spouse or spousal equivalent(excluding the value of the person’s primary residence), OR

Holds in good standing a financial professional license or designation, including a General Securities Representative license (Series 7), a Licensed Investment Adviser Representative (Series 65) or a Private Securities Offering Representative license (Series 82).

Some of the notable changes that were introduced in 2020 include updating language to include a spouse or spousal equivalent (domestic partner). The SEC added the new category to the definition that permits individuals to qualify as accredited investors based on certain professional certifications. Individuals also can qualify as an accredited investor if they are a “knowledgeable employee” of a private fund. In addition, the new rules clarify the entity types that may be considered as an accredited institutional investor. A limited liability company or family office can qualify as an accredited investor if total assets of the trust exceed $5 million, or if all of the equity owners for that entity are accredited investors.

How do I calculate my net worth?

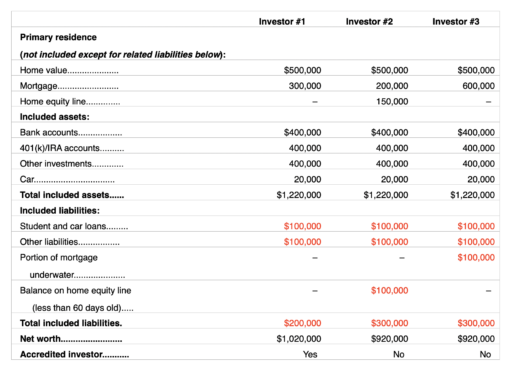

Calculating net worth simply involves adding up all of your assets (e.g., money and property of value, such as cash held in bank accounts, financial investments, jewelry and art) and subtracting all your liabilities (e.g., credit card debt and car loans). The resulting sum is your net worth. If calculating joint net worth with a spouse or spousal equivalent, it is not necessary that assets and liabilities be held jointly. Each can contribute individually owned assets. It also is important to note that the net worth calculation excludes any value in a primary residence (home) as an asset. It also does not include a mortgage or home equity line of credit on that home as a liability unless the amount owed is greater than the fair market value of the residence.

The below table provided by the SEC shows some different examples of calculations under the net worth test for an accredited investor. In this case only Investor #1 qualifies with a net worth that exceeds $1 million, whereas Investor #2 and #3 do not.

CanAm Capital Partners (CACP), a private equity investment management firm based in New York, provides accredited investors with select private investment opportunities with attractive risk-adjusted returns focused on geographies and assets where it has informational, operational, and other competitive advantages. CACP identifies and partners with national and regional operators who are specialized by asset type and/or geography and have demonstrated to be experts in their niche with the capacity and potential to successfully execute on their proposed projects, including multifamily apartments, commercial space, mixed-use buildings, hotels, and private equity funds. To date, CACP and its affiliates have funded $254 million of capital in 20 private equity real estate investments in major metropolitan areas of the U.S.Additional Resources

For additional investor educational information or questions about whether you qualify as an accredited investor for CACP’s offerings, visit the SEC’s website for individual investors, Investor.gov or contact CACP at info@canamcapital.com

CanAm Enterprises, with over three decades of experience promoting immigration-linked investments in the US and Canada, has a demonstrated track record of success. With over 60 financed projects and $3 billion in raised EB-5 investments, CanAm has earned a reputation for credibility and trust. To date, CanAm has repaid more than $2.26 billion in EB-5 capital from over 4,530 families. CanAm manages several USCIS-designated regional centers that stretch across multiple states. For more information, please visit www.canamenterprises.com.