Henley & Partners recently hosted an engaging global webinar featuring top experts to discuss the U.S. EB-5 Immigrant Investor Program and the potential implications of the proposed “Trump Gold Card.” In an era of shifting immigration policies, the session provided critical clarity for investors and families seeking U.S. residency options. Speakers included Min Wu, Global Head of Sales at CanAm Enterprises; Shhalu Hasarram, Private Client Advisor in Singapore for Henley & Partners; George Ganey, Immigration Attorney at Ganey Law Group; John Shoemaker, Attorney at Butler Snow LLP; and Dmytro Chernega, Private Client Advisor in Austria.

Understanding the Current EB-5 Landscape

Shhalu Hasarram opened the session by emphasizing the strength and stability of the EB-5 program. Passed into law through the Reform and Integrity Act of 2022 under the Biden Administration, EB-5 offers a secure path to U.S. residency. Investors were reassured that any changes to immigration laws, including new initiatives like the proposed Gold Card, must go through Congress. For families already participating in EB-5, or considering it, the program remains protected and valid through 2027, with grandfathering provisions offering added peace of mind.

EB-5 vs. Trump Gold Card: What’s the Difference?

George Ganey delivered an insightful comparison between EB-5 and the newly proposed Trump Gold Card. While the Gold Card would require a $5 million donation to the U.S. Treasury to reduce the national debt, it remains purely a concept, lacking formal legislation or regulations. In contrast, EB-5 is a well-established program with clear requirements: an $800,000 investment into a commercial enterprise that creates at least 10 full-time U.S. jobs. EB-5 investments are intended to stimulate economic growth, not merely fund government coffers.

“EB-5 is squarely on the books,” said Ganey. “The Trump Gold Card, at this point, is just a proposal.”

Ganey stressed that the Gold Card would require comprehensive legislative action, including decisions on vetting procedures, agency oversight, and application processes — a lengthy and uncertain path. Meanwhile, EB-5 remains the most viable, legal pathway for investors seeking U.S. residency today.

The Strength of Regional Centers: CanAm’s Leadership

Min Wu from CanAm Enterprises elaborated on the critical role of Regional Centers in the EB-5 process. Unlike direct EB-5 investments where investors must actively manage job creation, Regional Centers like CanAm offer a structured, passive investment model that meets USCIS requirements.

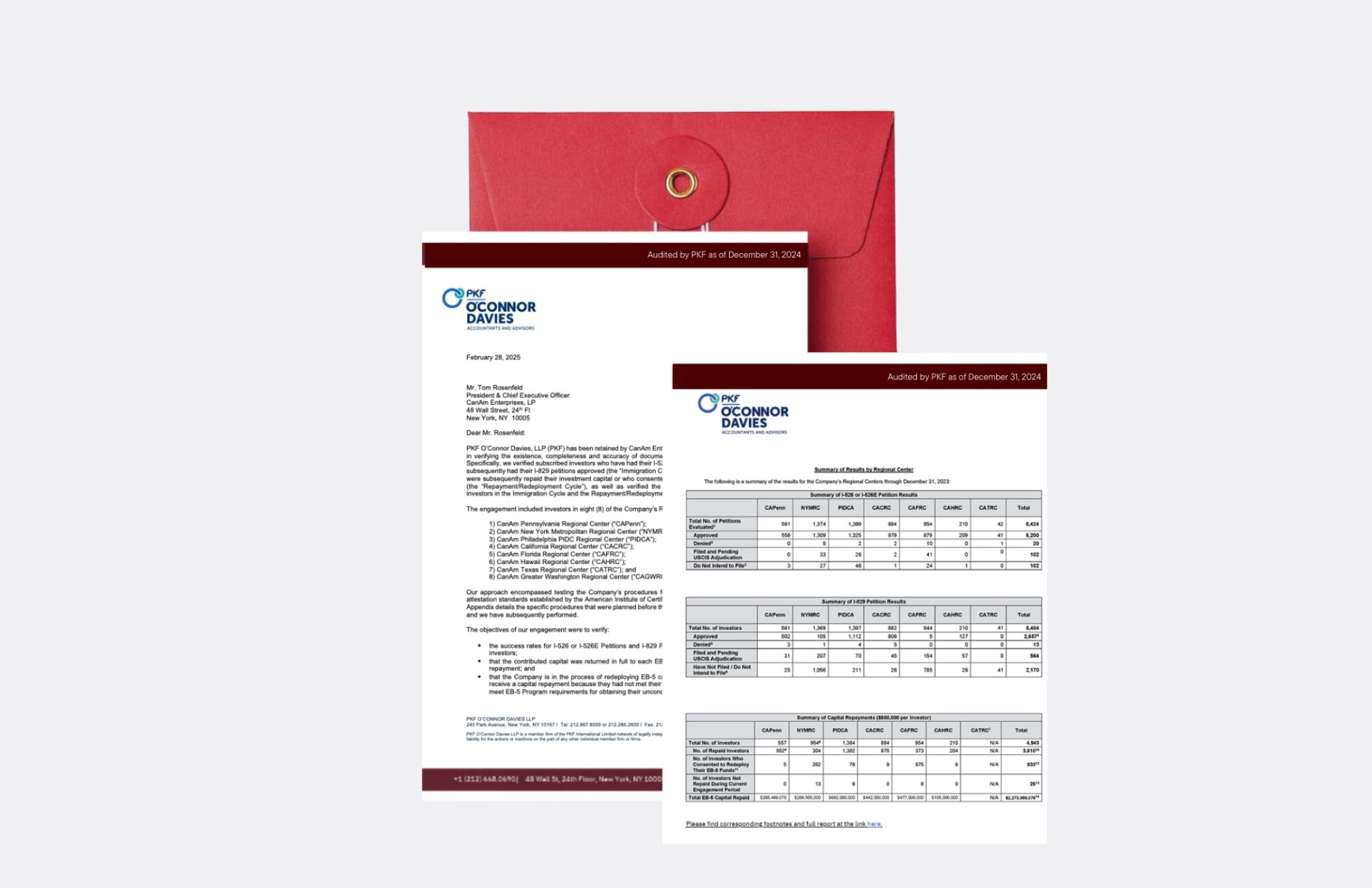

“CanAm is very proud to assure our investors that every single EB-5 project we have launched and submitted for approval has a 100% project approval rate,” Wu emphasized. “And we’ve repaid over $2.5 billion to our investors globally, which we believe is the best repayment track record in the entire EB-5 industry.”

Read More: Successful EB-5 Track Record

With offices worldwide, including New York, Singapore, India, and Vietnam, CanAm offers extensive support to investors at every step of the journey.

Importantly, Wu reassured current investors that their rights are protected: “If you have already completed your initial I-526E petition to start your EB-5 journey, you have nothing to worry about. Your status in the U.S. is protected.”

She also noted the surge in demand: “Since 2022, over 1,200 investors have submitted their EB-5 petitions with CanAm. The program remains extremely popular, especially among international students and H-1B holders in the U.S.”

Tax Considerations: Preparing for U.S. Residency

John Shoemaker addressed the often-overlooked but vital topic of U.S. tax obligations for new residents. He explained that the U.S. taxes residents on their worldwide income, using American definitions and accounting standards, which may differ from those in an investor’s home country.

“Worldwide exposure from the U.S. doesn’t just mean where your assets are located — it means using U.S. definitions and U.S. accounting methods,” Shoemaker cautioned. “Understanding when your exposure starts is critical for smart financial planning.”

He also urged caution around the Trump Gold Card proposal, noting that while it hints at exemptions from global income taxation, no official details or legal frameworks have been published.

Current Timelines and Practical Considerations

In the lively Q&A session, participants raised important questions about petition processing times and travel concerns under the current political climate.

George Ganey explained that EB-5 petitions linked to rural projects — which enjoy priority processing — are seeing approval timelines as short as 8 to 12 months. Adjustment of status filings from within the U.S. (popular among students and visa holders) are particularly efficient, sometimes leading to green cards within a year.

On travel, Ganey emphasized that despite isolated incidents making headlines, the risk of issues for approved EB-5 applicants remains extremely low.

Conclusion: The Time to Act is Now

The webinar concluded with a clear message: EB-5 remains the safest, most established investment migration route to the U.S. in 2025. Although the Gold Card proposal has captured attention, it is not a reality today and may take years — if ever — to implement.

“We assume that the Trump government will eventually launch the Gold Card at some point,” Wu said. “But very likely, the Gold Card and EB-5 will coexist, attracting different types of investors.”

For investors seeking stability, a defined legal pathway, and the opportunity to secure U.S. residency for themselves and their families, EB-5 stands strong. With a trusted Regional Center like CanAm and expert advisors from Henley & Partners, families can confidently navigate this important decision.

Dive Deeper Into EB-5: