Since the implementation of the EB-5 Reform and Integrity Act of 2022 (RIA), the I-526 and I-526E filing processes have changed significantly. However, one of the biggest challenges remains accessing reliable, real-time data from USCIS.

To bridge this gap, Invest in the USA (IIUSA), in collaboration with 11 regional centers and through the Freedom of Information Act (FOIA), collected and analyzed actual I-526E and I-956F processing times. The findings of their analysis were recently published in a comprehensive report.

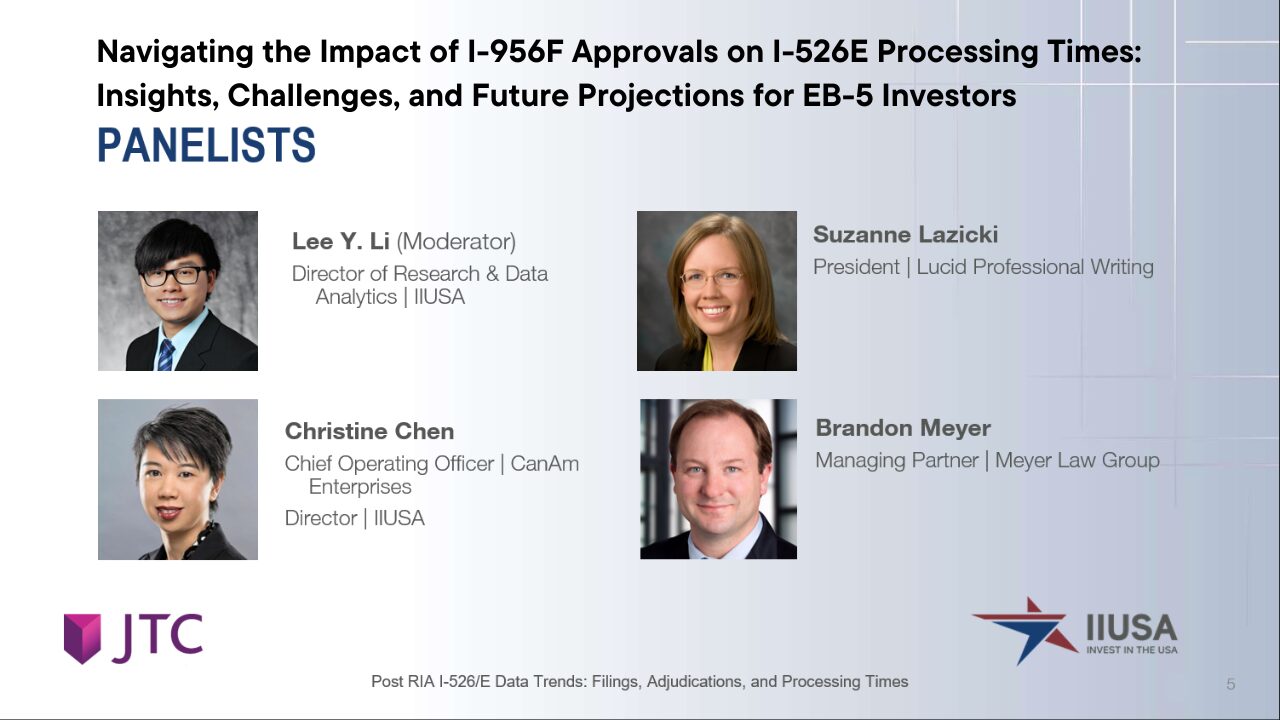

In conjunction with the release of the report, IIUSA hosted a webinar with industry experts, including CanAm’s Chief Operating Officer, Christine Chen, to discuss the latest trends in case filings, adjudications, and processing times in the EB-5 program. As the EB-5 market evolves under the Reform and Integrity Act (RIA), it’s crucial to analyze how these changes are impacting the industry, especially for investors and project developers.

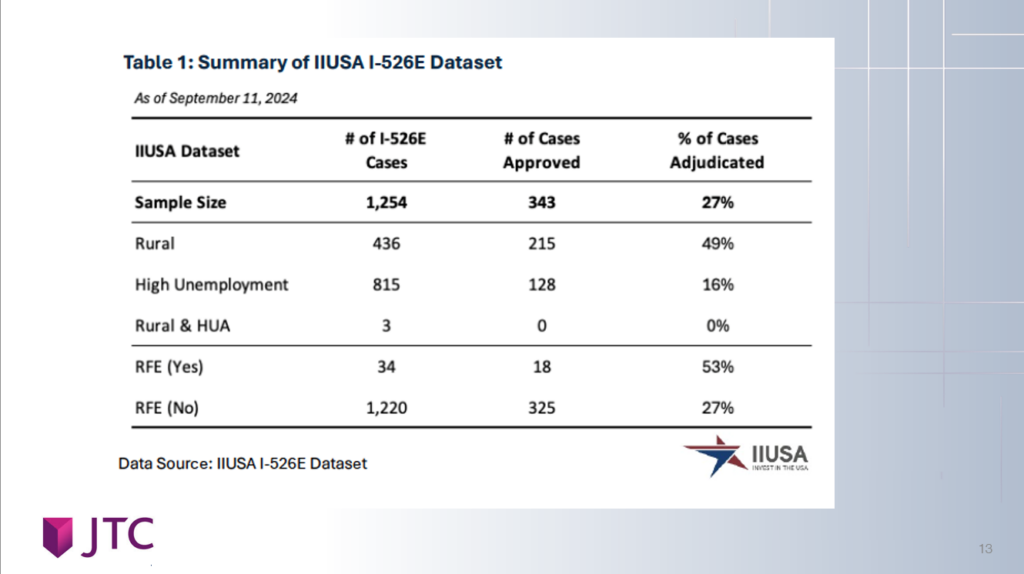

One of the most notable aspects of the analysis focused on how processing times for I-526E petitions vary depending on the type of project associated with the petition. The data collected from 11 regional centers representing over 1,200 I-526E cases revealed significant differences in processing times based on whether the investment was made in rural, high-unemployment, or other types of designated targeted employment areas (TEA).

WATCH NOW: Post-RIA I-526/E Data Trends: Filings, Adjudications, and Processing Times

Faster Processing for Rural Projects

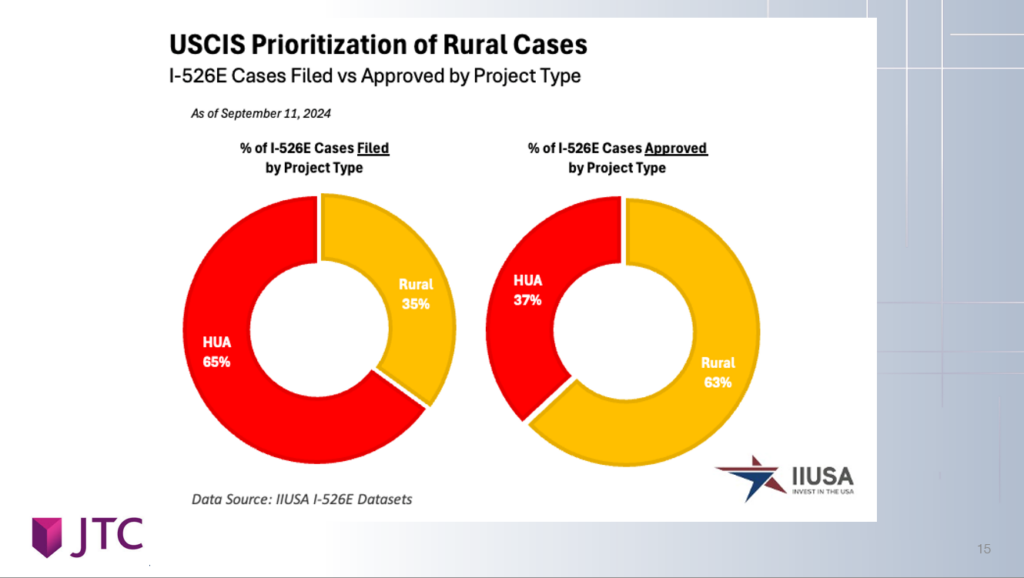

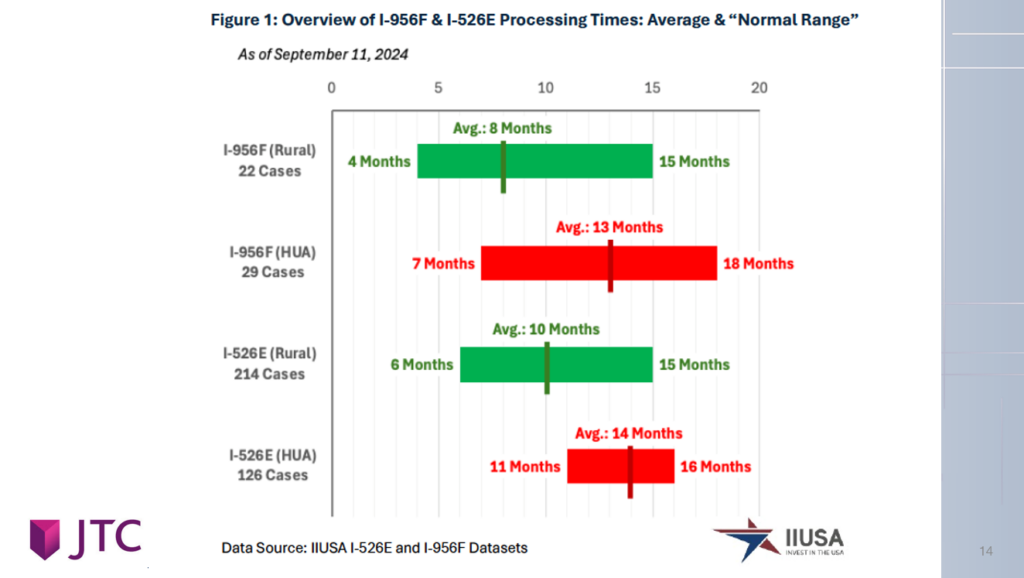

One of the most encouraging findings was the significantly faster processing times for petitions associated with rural projects. The data revealed that the average processing time for rural I-526E petitions was about 10 months. In contrast, petitions associated with high-unemployment urban projects took an average of 14 months. This four-month difference in processing times is likely reflective of the RIA’s prioritization of rural projects, which was one of the law’s major provisions designed to incentivize investments in rural areas.

Additionally, when considering the normal range of processing times, rural cases had a broader time window, ranging from 6 to 15 months. High-unemployment urban projects, while slower, had a more predictable processing window of 11 to 16 months. This finding underscores the advantage for investors who choose rural projects, as they can potentially receive their approvals more quickly, albeit with a wider variance in processing times.

Impact of I-956F Approvals on I-526E Processing

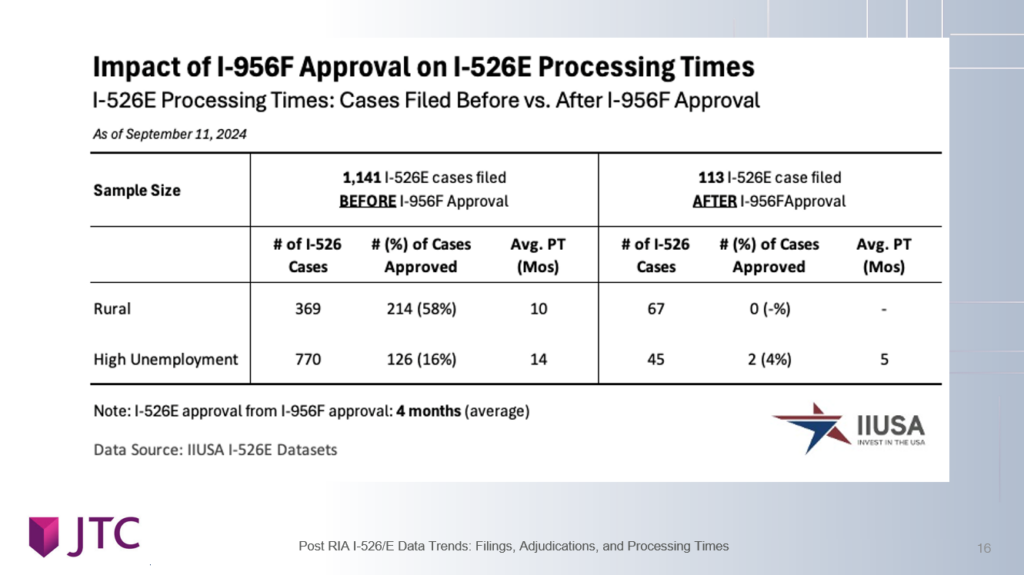

Another critical finding relates to the relationship between the approval of I-956F petitions and I-526E processing times. For I-526E petitions to be adjudicated, the associated I-956F must first be approved. The analysis revealed that petitions filed after I-956F approval appeared to be processed faster, with some cases being approved in as little as five months. However, the data sample for this specific scenario was limited, and thus more data is needed to confirm whether this is a consistent trend.

Nevertheless, this finding highlights the importance of timing in filing I-526E petitions. Investors may benefit from waiting until their project’s I-956F is approved, as it could lead to faster adjudication of their own petitions.

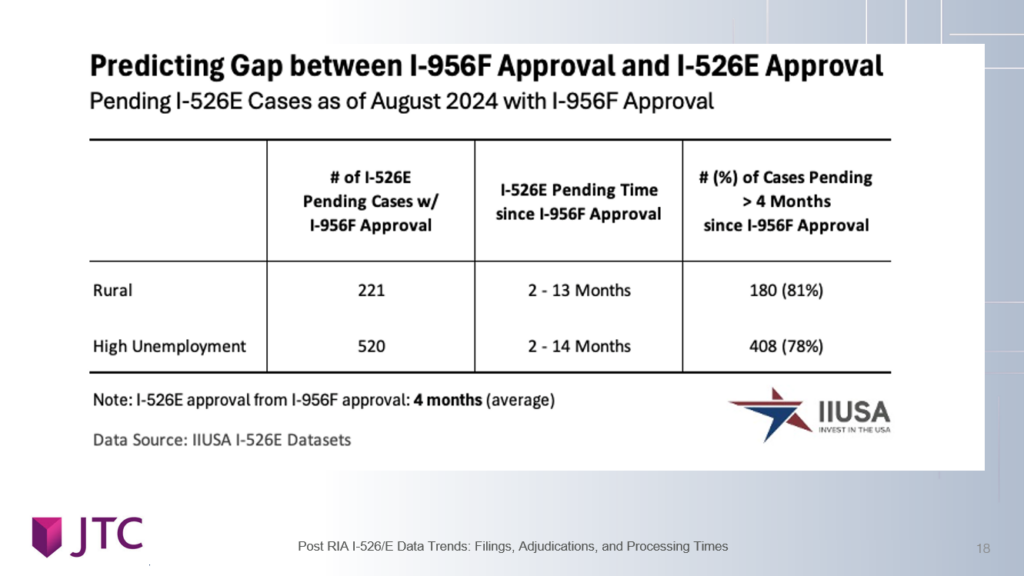

Pending Cases and Future Expectations

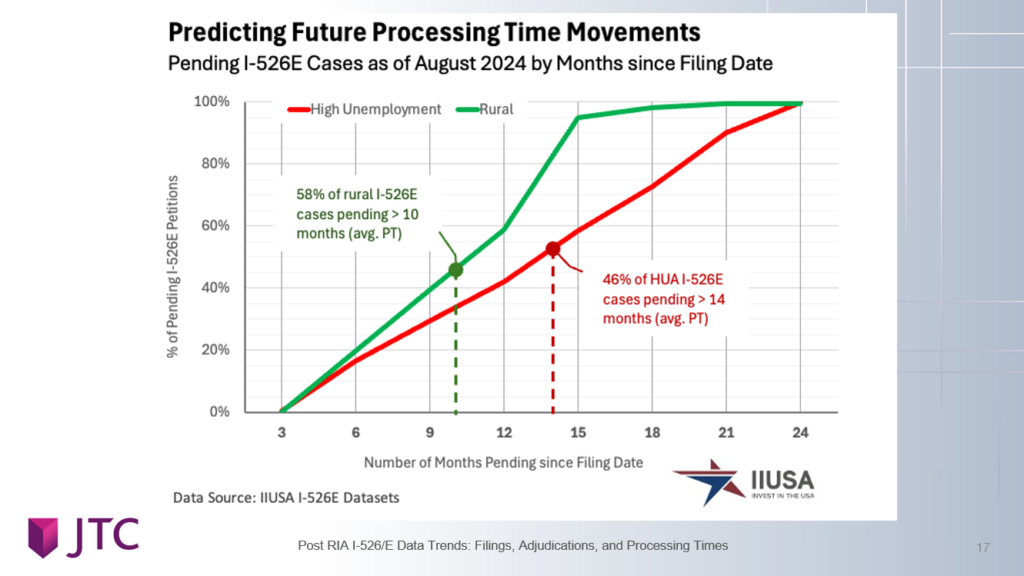

The report also provided insights into the current backlog of pending I-526E petitions. Over 58% of rural petitions have been pending for more than 10 months, which suggests that the processing times for future cases may increase as USCIS works through this backlog. For high-unemployment urban projects, less than half of the cases have been pending for more than 14 months, indicating that these cases may experience more consistent processing times moving forward.

This analysis of pending cases is crucial for setting expectations. While current processing times for approved petitions are relatively fast, the backlog suggests that future processing times may lengthen as USCIS catches up with its workload.

Conclusion

The initial findings from this groundbreaking data collection effort provide valuable insights into I-526E processing times and highlight the advantages of investing in rural projects under the RIA framework. With average processing times of 10 months for rural projects compared to 14 months for high-unemployment urban projects, investors who prioritize rural investments may see faster results.

The relationship between I-956F and I-526E approvals also offers important strategic information for investors. Filing after I-956F approval may lead to quicker adjudications, though more data is needed to confirm this trend.

Overall, while the data collected so far offers important benchmarks, the backlog of pending cases indicates that processing times may increase in the future. Investors and regional centers must continue to monitor this evolving landscape, and ongoing data collection will be key to providing updated and accurate information moving forward.

As the EB-5 industry adapts to the changes brought about by the RIA, the IIUSA’s efforts to collect and analyze industry-generated data will continue to be an essential tool for helping investors and regional centers make informed decisions in this complex and competitive environment.