The EB-5 community received critical insights on the implications of the January 2025 Visa Bulletin during a recent webinar moderated by Pete Calabrese, CEO of CanAm Investor Services. The panel featured Charlie Oppenheim, Director of Visa Consulting at Wolfsdorf Rosenthal LLP and former Chief of the Visa Control and Reporting Division at the U.S. Department of State, and Joey Barnett, Partner at Wolfsdorf Rosenthal LLP.

The conversation offered clarity on how recent visa developments will impact EB-5 investors, particularly those considering rural and high-unemployment set-aside categories.

Visa Bulletin Warning Shot: Key Takeaways

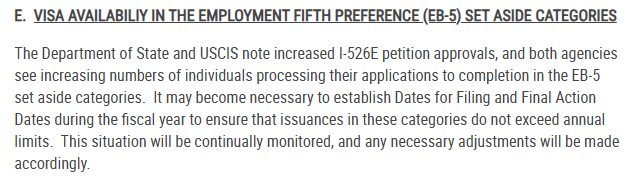

The January 2025 Visa Bulletin included a cautionary note, referred to as “Footnote E”.

This note signals that demand for EB-5 visas is growing, particularly among investors from China and India. While no immediate retrogression is expected, the warning serves as a reminder to act swiftly.

Charles Oppenheim explained:

“This is a warning shot to prepare people for the future. We don’t see final action dates for set-aside categories happening before summer 2025 at the earliest.”

This means that while set-aside categories such as rural, high-unemployment, and infrastructure remain current (C), investors should not wait. “The opportunity is now.”

Why Set-Aside Categories Offer a Unique Opportunity

EB-5 investors filing in set-aside categories can currently concurrently file their I-526E petition and adjustment of status (Form I-485). As Joey Barnett pointed out:

“The interim benefits of concurrent filing—employment authorization (EAD) and advanced parole—allow investors to remain in the U.S. even if retrogression occurs later.”

Investors in the U.S. on H-1B or other visas can seize this opportunity to secure a green card pathway while benefiting from interim work and travel privileges.

Interpreting the January Bulletin’s Numbers

The “Final Action Dates for Employment-Based Preference Cases” chart highlights the significant backlogs in EB-2 and EB-3 categories for China and India.

In contrast, the EB-5 set-aside categories are current—a major incentive for investors seeking faster access to green cards.

“If you’re waiting in EB-2 or EB-3 and have the means for EB-5, you now have two shots at a green card,” said Oppenheim. “Even when final action dates appear, EB-5 set-aside lines will still move faster.”

The Importance of Acting Now

Both experts underscored that waiting for further developments could mean missing out on this current window of opportunity. Joey Barnett urged potential investors to act quickly:

“If not now, when? The priority date is your place in line. Get your spot while you can.”

Barnett also addressed concerns about the financial commitment of EB-5:

“EB-5 is one of the most personal investments people will make. It’s about securing a future in the U.S. for you and your family—not just a monetary return.”

The EB-5 Reform and Integrity Act has made this process more investor-friendly by decoupling the sustainment period from visa availability. This means investors may recoup their investment before receiving their green cards.

Practical Steps for Investors

For investors ready to move forward, the panelists provided practical advice:

- Start with Your Source of Funds: Work with an experienced immigration attorney to ensure your funds are well-documented.

- Choose the Right Project: Select a reputable regional center with a track record of job creation and capital repayment.

- Act Without Delay: As Oppenheim emphasized: “You want to be as close to the front of the line as possible. Lines will develop.”

The panel also highlighted the CanAm and JTC white paper as an invaluable resource for conducting project due diligence.

Read More: EB-5 Investor Due Diligence: Finding the Right Project for Immigration Success

Why EB-5 Matters for Investors in the U.S.

For many investors currently in the United States on H-1B visas, EB-5 offers a reliable backup plan. Barnett noted the increasing interest from this group:

“My clients today are mostly from within the U.S. They’re tired of waiting in EB-2 or EB-3 backlogs, concerned about aging-out children, or worried about job instability in industries like tech.”

The EB-5 program provides a path to stability, allowing investors to work freely, travel without restrictions, and remain in the U.S., even during visa retrogression.

A Timely Call to Action

The January 2025 Visa Bulletin is not a cause for immediate alarm but serves as a preemptive warning. As both Joey Barnett and Charles Oppenheim emphasized, acting now ensures investors secure their place in line before demand escalates further.

In closing, Pete Calabrese summarized the conversation:

“This is a unique investment with a tremendously valuable outcome—the opportunity to live and work in the U.S. indefinitely. The time to act is now.”

Conclusion

The January 2025 Visa Bulletin signals rising demand for EB-5 visas, particularly in the set-aside categories. Investors are urged to capitalize on the current availability to secure interim benefits and a pathway to U.S. permanent residency.

For those considering EB-5, the time is right to consult with experienced immigration professionals, select a strong project, and secure your place in line.

Dive Deeper into EB-5:

- Demystifying the Visa Bulletin

- Transitioning from the H-1B to EB-5 Visa: A Comprehensive Guide

- Post-RIA EB-5 I-526E Data Trends: Insights and Implications for Investors and Stakeholders