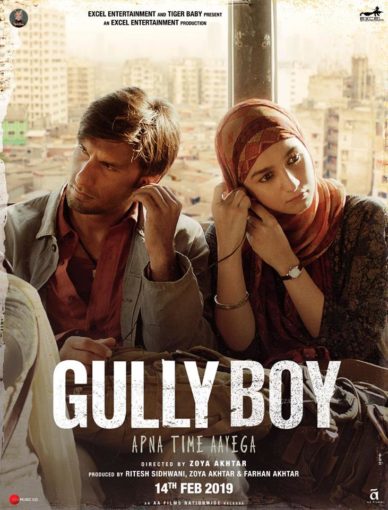

As the winter cold hits the New York City streets in late January, we sit down with Mr. Gangadhar Kadaru to discuss his story and living the modern-day “American dream”. Mr. Kadaru is a successful businessman and investor whose entertainment distribution company, Viva Entertainment, just released the highly anticipated Indian movie “Gully Boy” in North American theaters.

Mr. Kadaru is a Chennai native who left India in 1991 to pursue a marketing career in Dubai. After several years of working to build a distribution network for marketing Indian music across the Middle East, he decided to move to Canada in 1997 to pursue his own goals, and as Mr. Kadaru says, “for family stability” as well. While Mr. Kadaru is very humble about his beginnings outside of India, he established a distribution company with a Singapore-based entity and started distributing Asian-Indian entertainment products across the entire North American continent from his new base in Canada.

After settling in Canada, Mr. Kadaru received lucrative offers to return to the Middle East, but he decided to stay put: “I was happy in North America, I wanted to stay here,” he adds. His decision to stay paid off; he was eventually offered a partnership in a DVD distribution business, an opportunity that also brought Mr. Kadaru to New Jersey in 1999, where he established his own company, Viva Entertainment. During those years, he was operating two businesses simultaneously, while shuttling back and forth between New Jersey and Toronto.

Although Mr. Kadaru became a Canadian citizen in 2001, the ambitious business man still encountered problems with the introduction of the Patriot Act after 9/11. Owning a business was not a problem, but actively managing the operation as a foreign business owner was an issue. The situation was becoming increasingly more challenging and his constant travel created an uncertainty in his business activity.

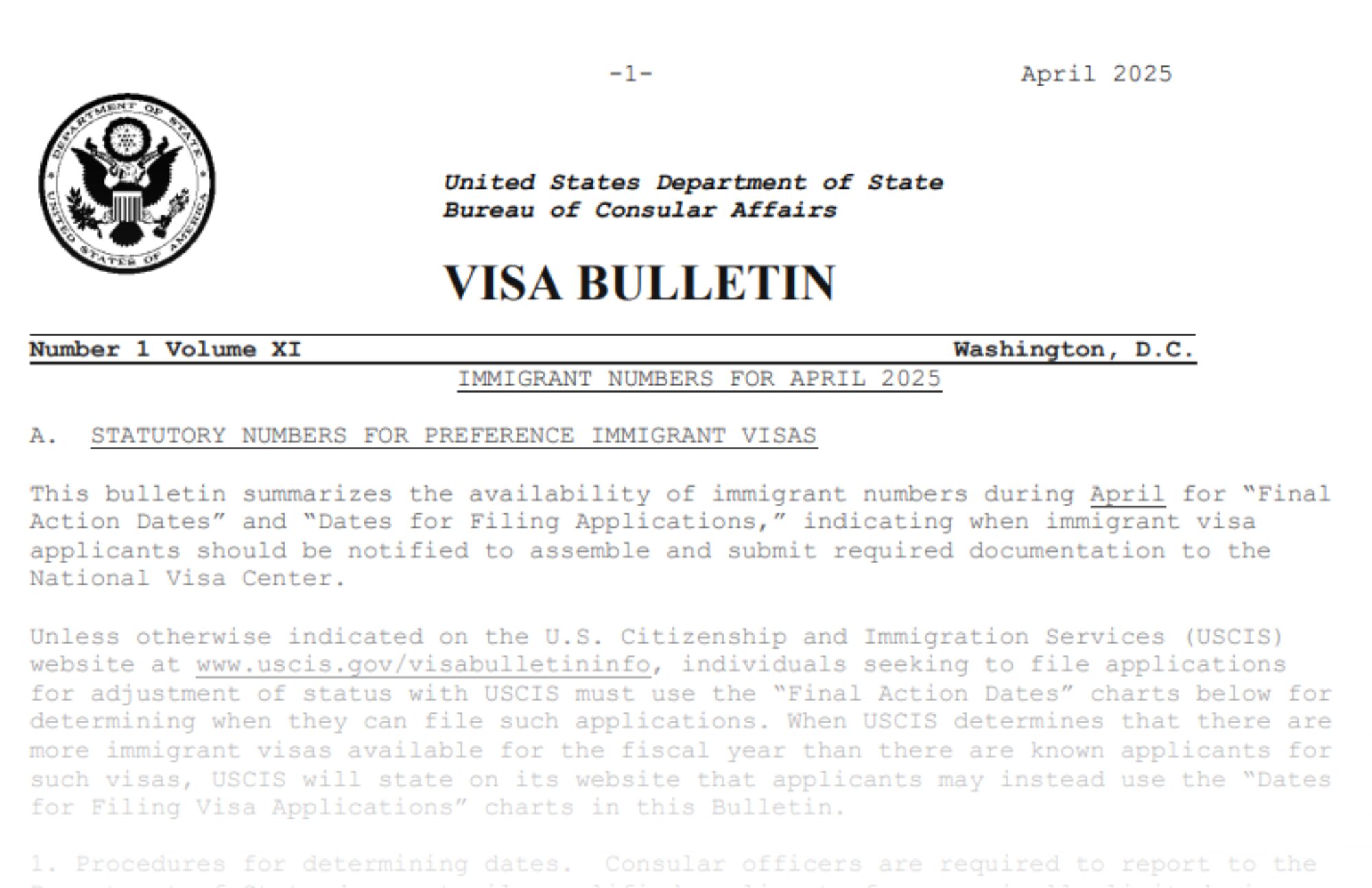

With many challenges at that time, Mr. Kadaru started to seek opportunities to obtain permanent residency in the United States so that he could continue to run his successful small business and finally bring more stability to his business and family life, especially for his children. “When you do businessin the U.S. and you are not permanent, it is always at the back of your mind – none of the decisions you make are permanent because you are not a permanent resident here,” Mr. Kadaru explains. As one of the earliest EB-5 investors from India, Mr. Kadaru admits he was initially very hesitant to make the move to invest $500,000 in an EB-5 project with the New York-based EB-5 regional center operator, CanAm Enterprises. “I checked and verified for two years, I did my due diligence before I became comfortable to make my investment with my hard-earned money.” Mr. Kadaru invested his money into an EB-5 project which financed a new ticketing system for the Southeastern Pennsylvania Transportation Authority (SEPTA) in 2013 through CanAm Enterprises. Regarding his due diligence process, Mr. Kadaru explains, “You need to check, do your homework and invest with the right EB-5 company with a proven track record.” EB-5 projects are usually structured as low-interest loans with a repayment term of five to seven years. Regional centers pool capital and provide funding to new commercial enterprises that will create over 10 U.S. jobs per investor, one of the essential requirements for receiving permanent residency through the EB-5 Program.

After making his investment, Mr. Kadaru was able to focus entirely on managing his distribution business while he received regular updates on his EB-5 investment and his immigration process. “After getting my green card, things happened,” Mr. Kadaru describes how the green card investment finally brought peace to his life. “I stopped thinking about the immigration issues, and my wife, who couldn’t work before, became a realtor.” The Kadaru family is now in the process of applying for a citizenship in the United States. “When people ask me about my green card, I say one word – stability. Stability for me, my family, and for my business.” Once Mr. Kadaru received his green card, he was able to focus on his business and make new investments. Without a green card, banks wouldn’t consider a loan application for a small business. “Once you check the box ‘permanent resident’, things moved forward.” With the emerging competition in the form of mainstream streaming services such as Netflix or Amazon Prime, the savvy independent distributor refocused his energy on bringing Indian movies to release in cinemas across North America. Nowadays Mr. Kadaru distributes five Indian movies on average every year.

When looking back at his beginnings in the U.S., Mr. Kadaru reminisces: “I just wanted to live the American dream, work hard and live in a big house in a wooded area.” Mr. Kadaru was also able to save a significant amount of money on his children’s college tuition. “Being green card holders, my children paid the lower local resident fees; otherwise we would have had to pay twice as much as international students.” “I have two kids and you can do the math. That saved my family a substantial sum of money! That’s the benefit of permanency.” Both of Mr. Kadaru’s sons found success in IT – they are pursuing careers in database management, artificial intelligence, and virtual reality. IT is a popular choice among the American-Indian community in the U.S., and it is also one of the highest paying fields in the country.

“When I look back at the past six years, it’s a blessing,” Mr. Kadaru says of his story, one that spanned across several countries before settling down in the United States. With the new movie “Gully Boy” released in cinemas across Canada, United States and the Caribbean, he is happy to bring yet another Bollywood movie to entertain the Indian, Pakistani, Sri Lankan, and Arab communities in America and perhaps, a much broader audience this time as well. Gully Boy’s story may resonate with second generation immigrants who are not generally interested in Hindi movies as well as with other American communities due to its story about an up and coming rapper from Mumbai that is expected to connect with millennials and the youth.

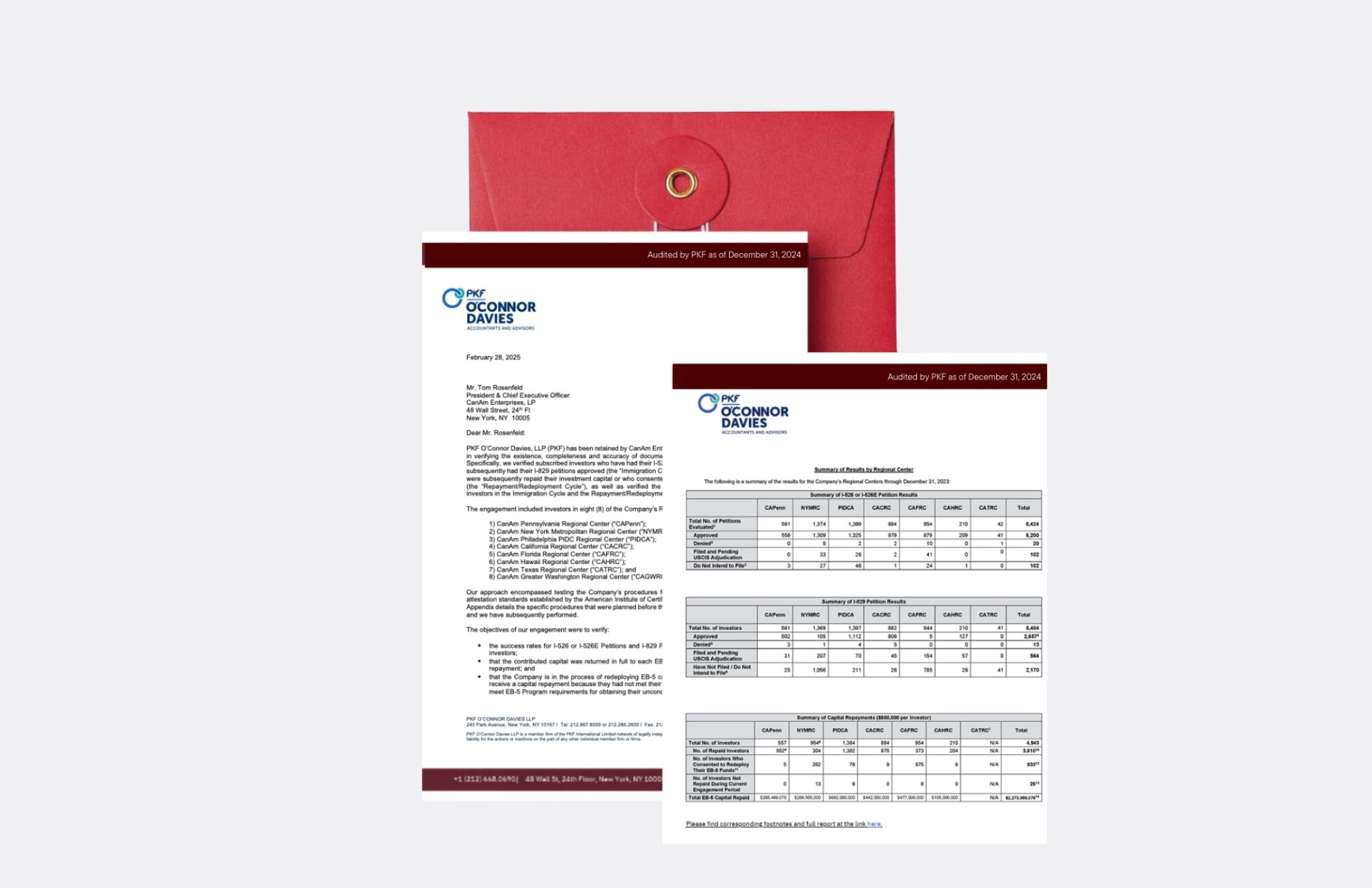

CanAm Enterprises, with over three decades of experience promoting immigration-linked investments in the US and Canada, has a demonstrated track record of success. With over 60 financed projects and $3 billion in raised EB-5 investments, CanAm has earned a reputation for credibility and trust. To date, CanAm has repaid more than $2.26 billion in EB-5 capital from over 4,530 families. CanAm manages several USCIS-designated regional centers that stretch across multiple states. For more information, please visit www.canamenterprises.com.