EB-5 Visa program is a reliable avenue to live, work, study, and travel anywhere in the United States.

The EB-5 Visa Program is extremely popular among Indians who want to leave India and settle in America. The EB-5 Residency Program is a type of investor visa that allows people of all nationalities to obtain permanent residency in the United States by making a specific investment in US commercial ventures.

The program allows investors to live permanently in the United States after investing at least $800,000 in a Targeted Employment Area or $1,05 million in a US commercial enterprise and simultaneously generating at least 10 full-time jobs for US citizens within 2 years.

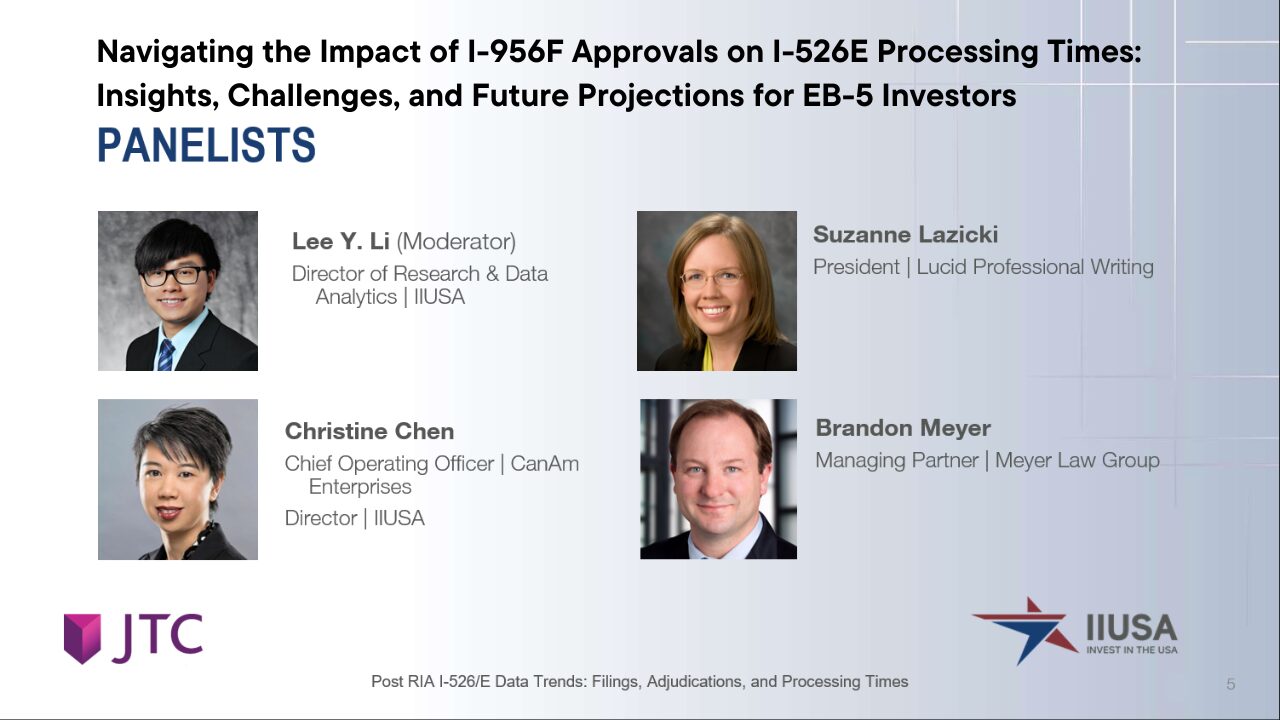

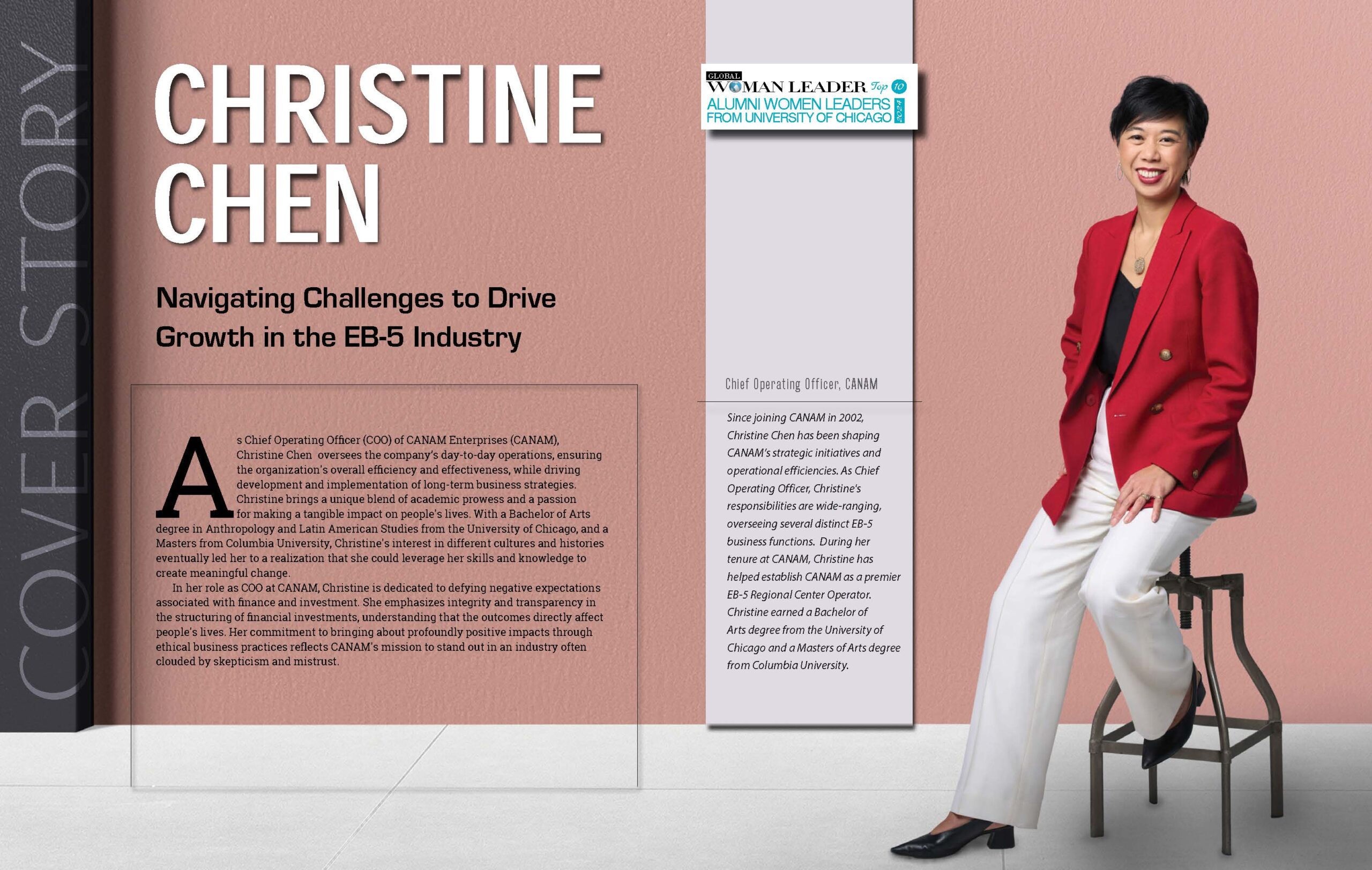

Peter Calabrese, CEO of CanAm Investor Services, shares key insights with Financial Express Online about the growing number of Indian applicants for the EB-5 Visa program, the challenges they face, the impact of recent legislative changes, and the impact of the US Fed’s 500 basis point rate hike campaign on the EB-5 industry.

Could you elaborate on the increasing trend of Indian applicants for the EB-5 Visa program and what might be driving this surge in interest?

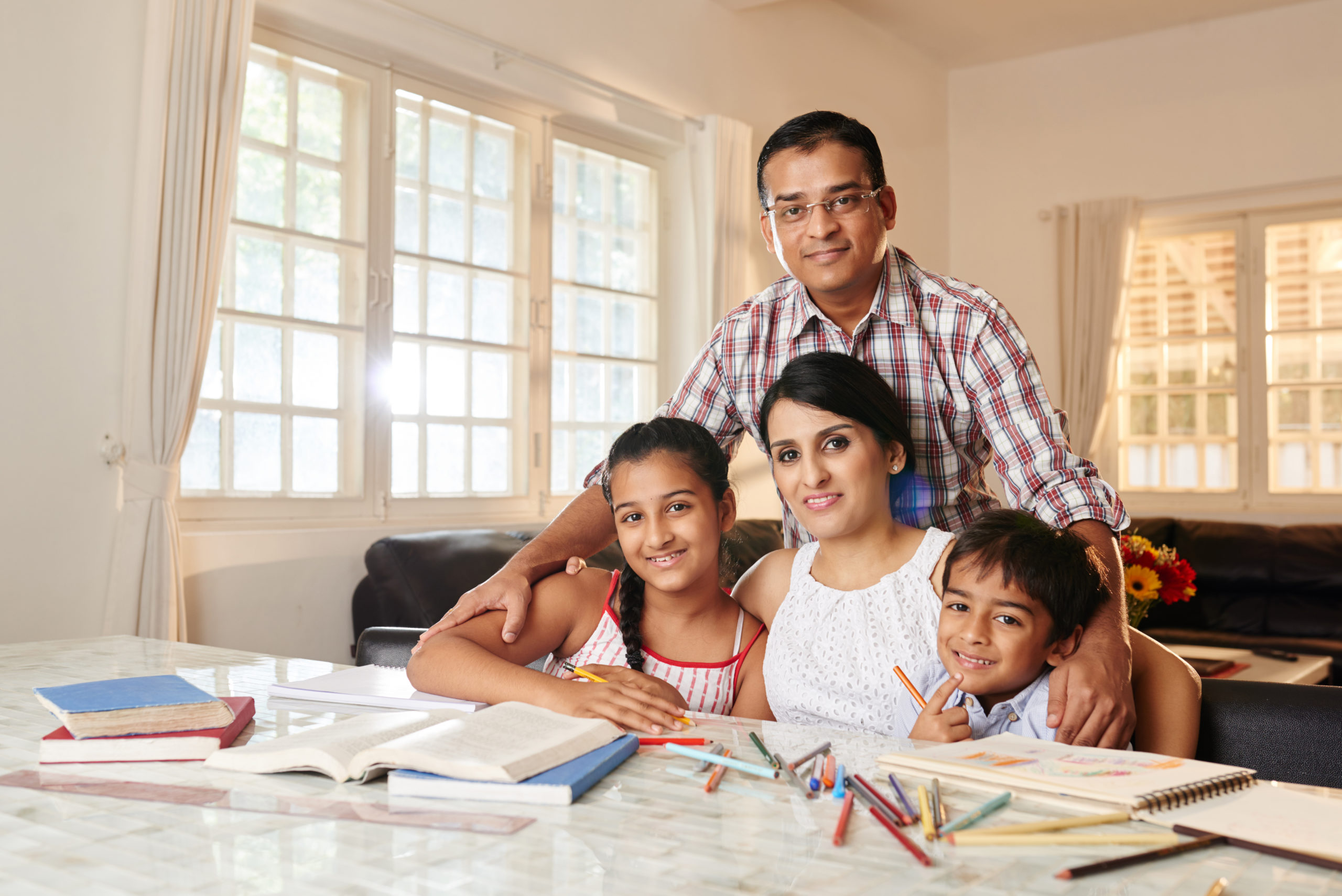

From FY 2019 to FY 2022, the number of EB-5 visas issued to Indians, according to USCIS data increased by about 82 percent. This surge can be attributed in part to various motivating factors that resonate deeply with Indian families and individuals. Primarily, the pursuit of a stable and secure future for their families stands out as a dominant driver.

Our experience is that Indian applicants view the EB-5 Visa program as a reliable avenue for themselves and their children to live, work, study, and travel anywhere in the United States. They understand that the U.S. offers world-class schools and universities and has one of the strongest economies in the world, which continues to grow and expand.

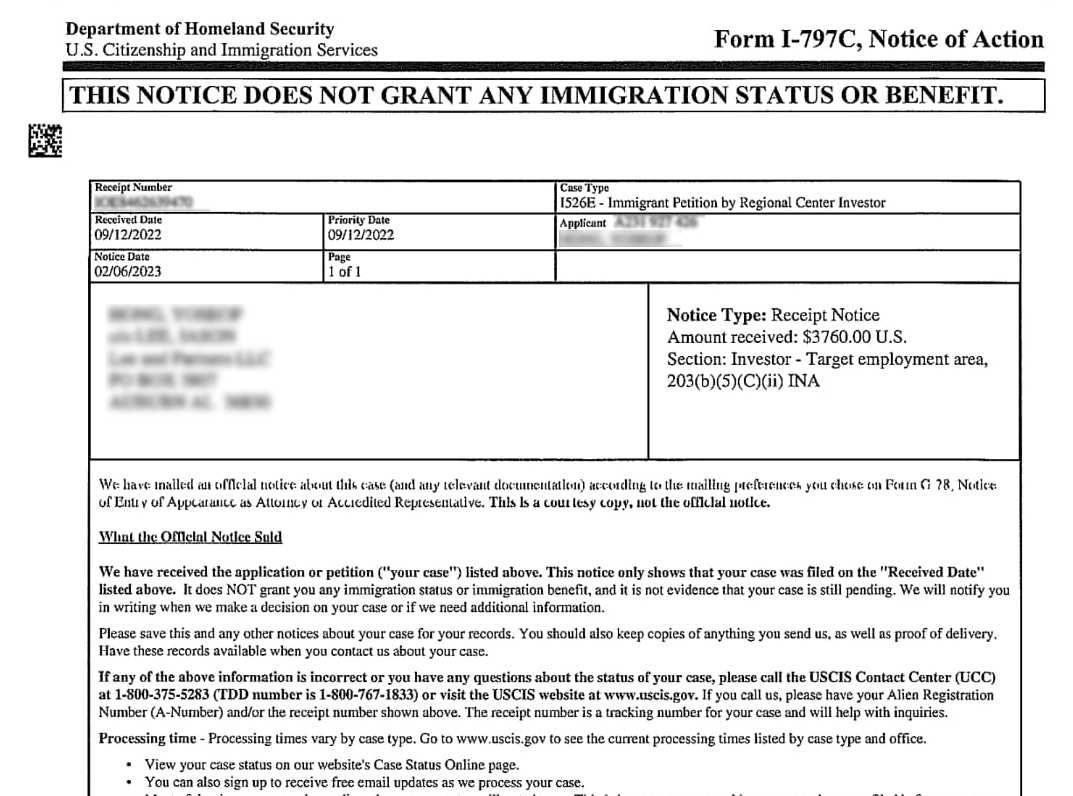

In many cases, children of Indians are already in America on a student or work temporary visa and can benefit from another RIA reform that allows them to remain in the U.S. and adjust their status for permanent residency while filing an EB-5 petition.

This “concurrent filing” option allows them to enjoy U.S. green card benefits while their EB-5 petition is in process, and avoid having to return to India to wait for consular processing. In FY 2023, about 10 percent of India’s EB-5 visa applicants did not reside in their home country, which far surpasses the 3 to 4 percent averages from other major EB-5 visa countries. This signals that Indians are exercising their concurrent filing option while still residing in America.

What challenges do Indian applicants encounter in the EB-5 Visa process compared to applicants from other countries?

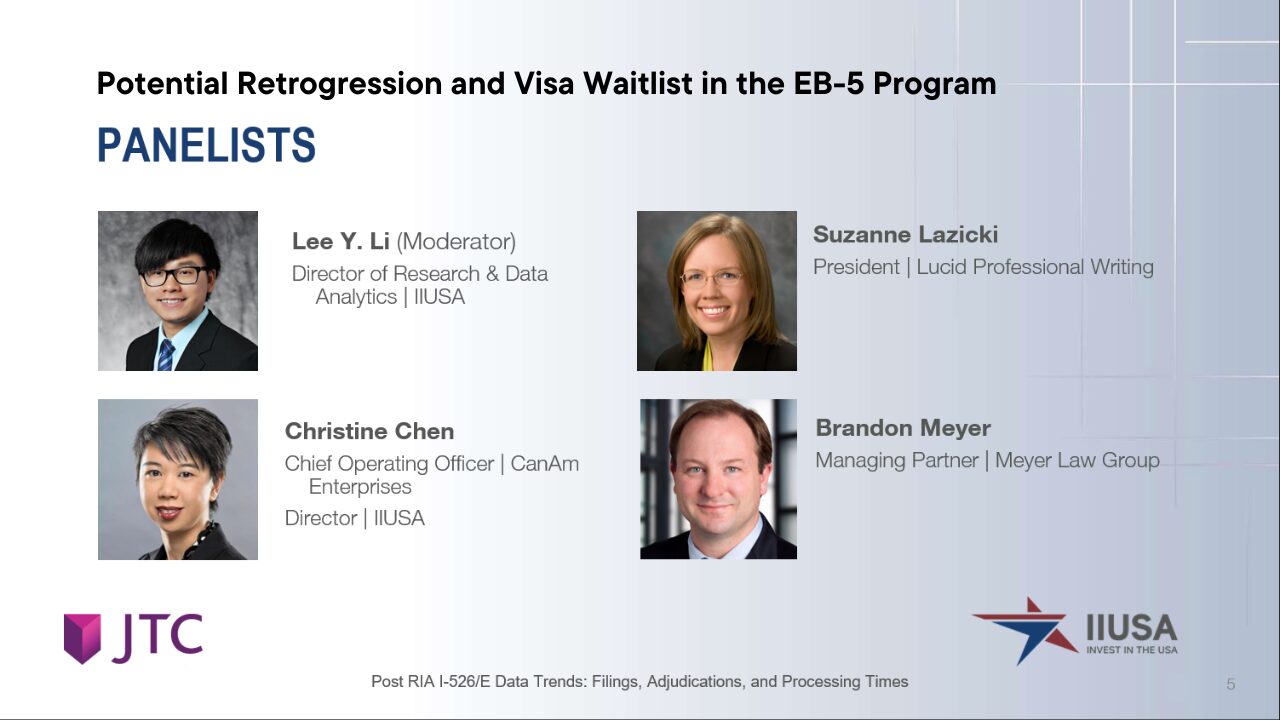

One of the foremost challenges faced by Indian applicants pertains to prolonged wait times resulting from visa backlogs. As the EB-5 program operates under a per-country quota, applicants from countries like India contend with delays arising from the annual visa limits, leading to extended processing timelines.

Moreover, the intricacies of the EB-5 visa application process pose another significant challenge, demanding meticulous navigation through multifaceted documentation requirements, intricate investment regulations, and the various stages of USCIS processing.

Selecting an appropriate investment project further compounds these challenges, as Indian investors grapple with aligning their preferences, risk appetite, and the program’s stringent criteria, often necessitating extensive research and due diligence.

Despite these challenges, Indian applicants hold notable advantages within the EB-5 program. Their strong command of the English language significantly eases communication and integration upon relocation to the United States, facilitating smoother social assimilation and streamlined business interactions.

Furthermore, the high educational qualifications and professional skills characteristic of many Indian applicants serve as a significant asset in the competitive U.S. job market, contributing positively to the nation’s economy.

Additionally, the inherent cultural adaptability prevalent within Indian culture fosters flexibility and versatility, aiding individuals, and families in navigating the diverse cultural landscape of the United States with greater ease and adaptability.

How has the recent Fed rate hike impacted the EB-5 Visa program?

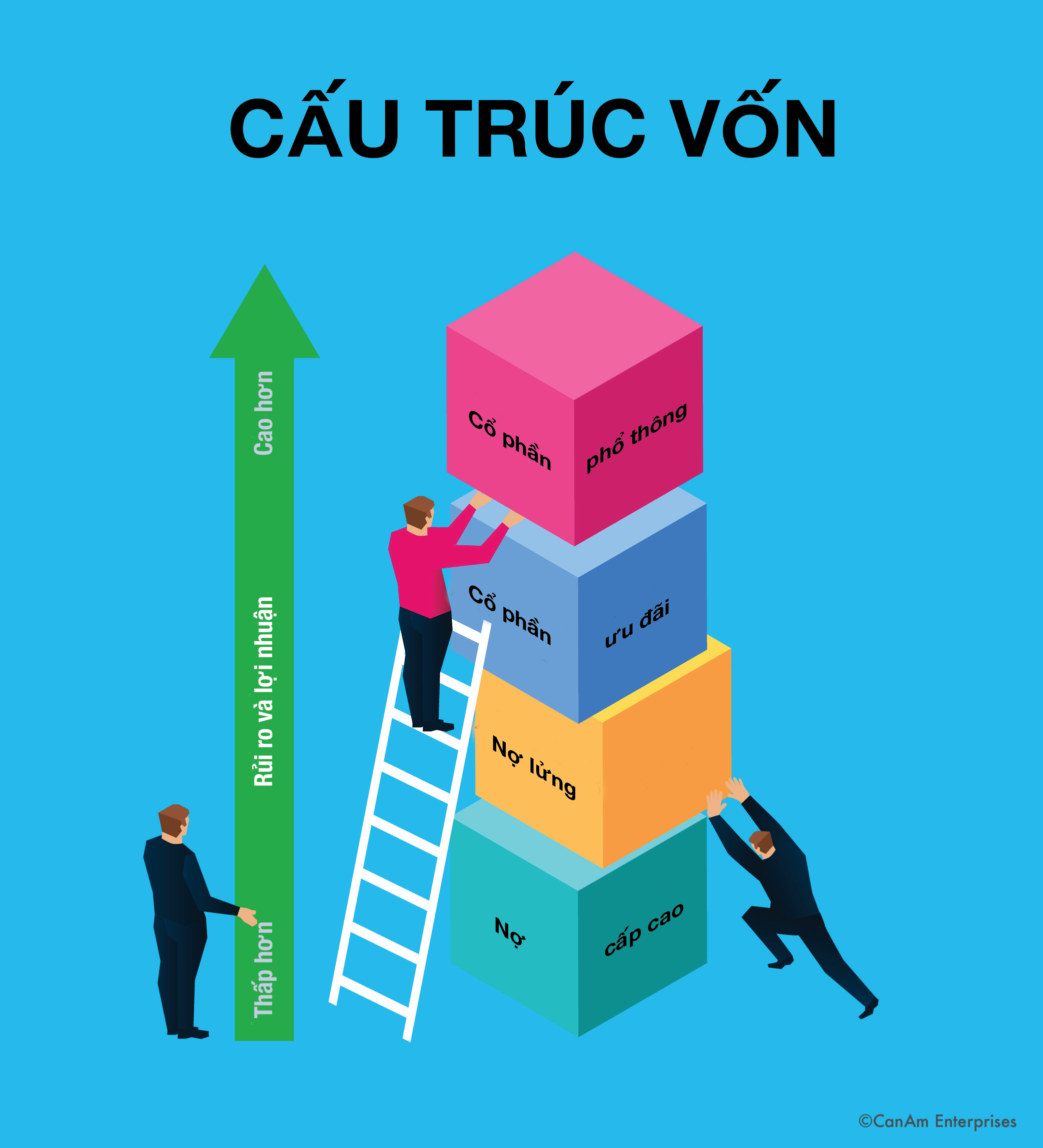

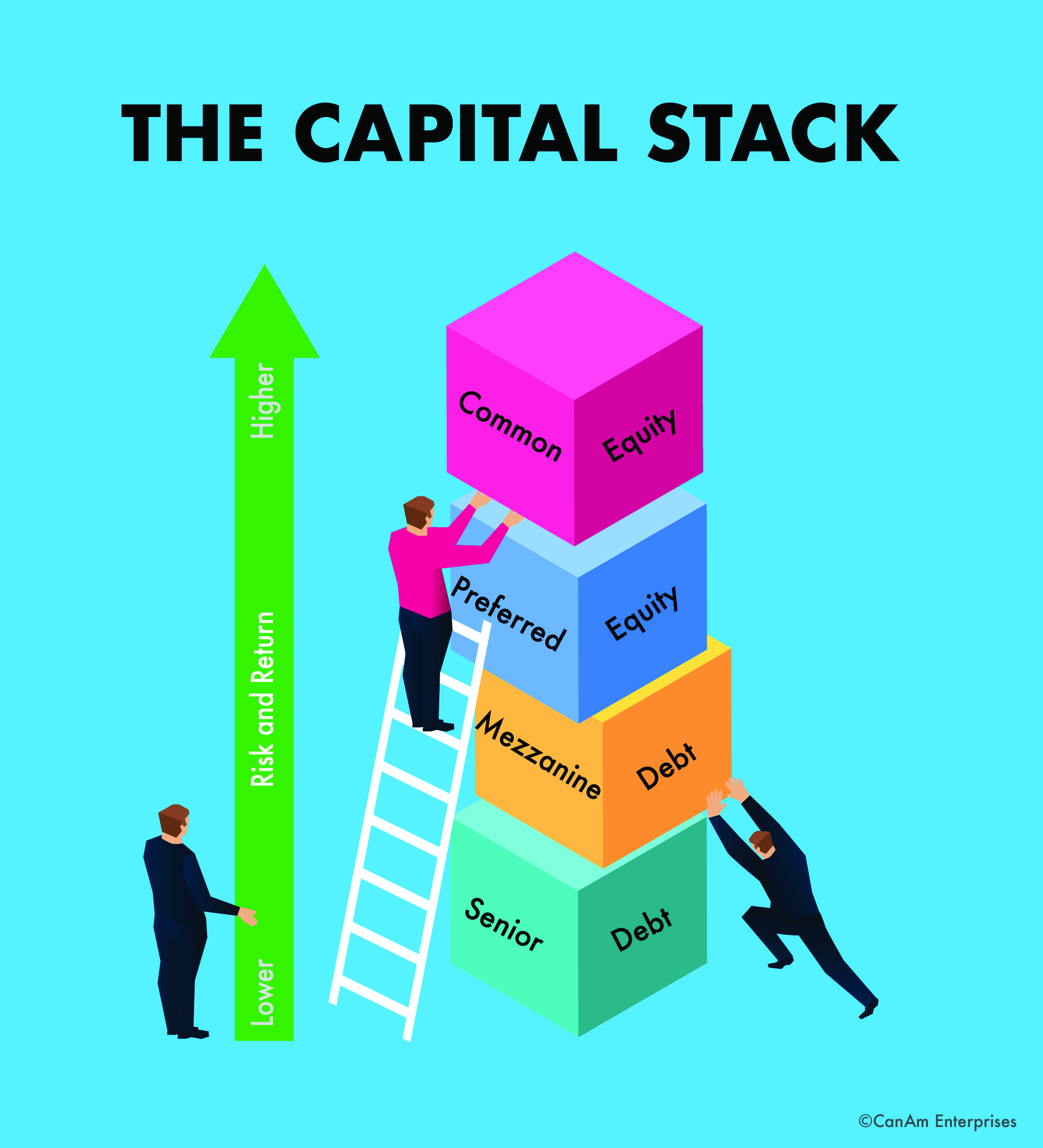

The rising interest rate environment and the availability of capital are having a profound impact on a developer’s capacity to undertake traditional real estate development projects through traditional financing sources.

The capital markets are tight, which has made EB-5 lending a more attractive source of financing – not unlike an EB-5 financing trend during the 2008-2009 period when the global banking sector was in crisis.

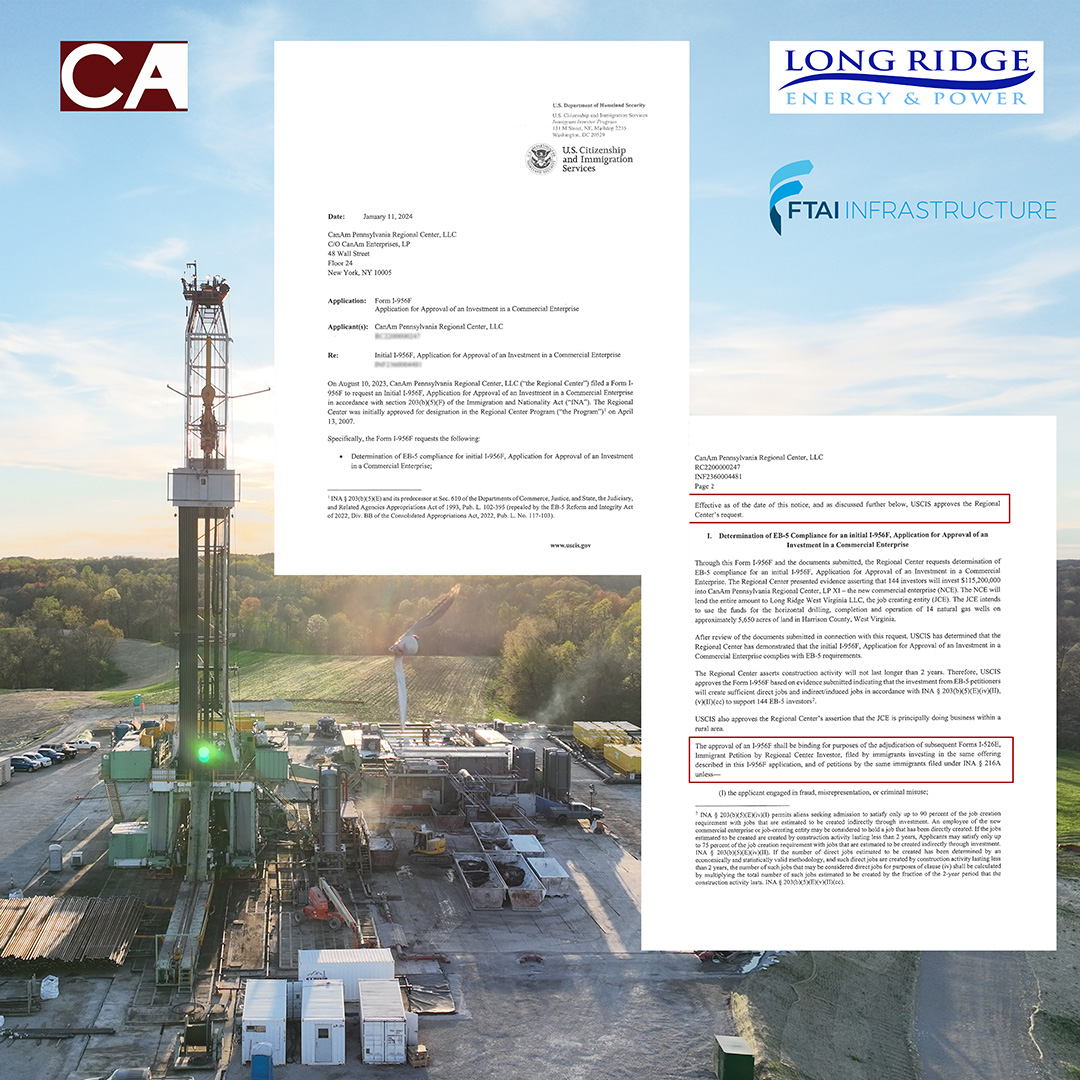

While capital markets have changed, so too have the types of EB-5 projects. The rural-based, infrastructure-oriented projects are getting increased attention, and for good reason – they’re incentivized by the RIA and other government programs and we view them as a more conservative and secure type of EB-5 investment to achieve the dual goals of a green card and a return of invested capital.

Can you discuss the impact of recent legislative changes on the EB-5 industry and how these changes have influenced the decision-making process of HNIs considering this investment route?

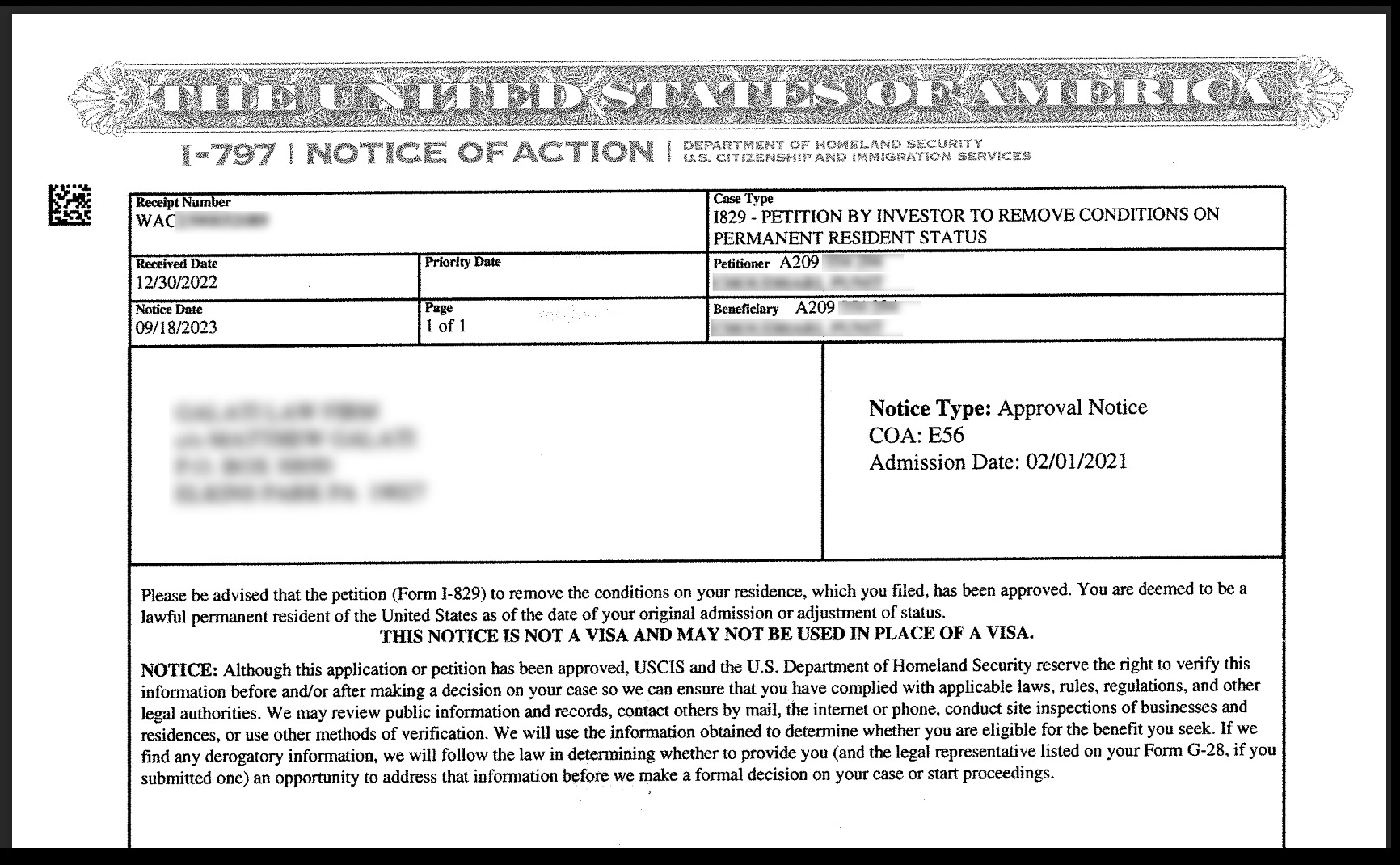

Recent legislative adjustments have underscored the industry’s commitment to fostering integrity and accountability within the EB-5 program. The reforms are intended to ensure that Regional Center operators — who are entrusted with the responsibility of every immigrant investor’s EB-5 journey — meet the new rigorous standards for ethics, disclosure, reporting, and regulatory compliance in how they conduct business.

More than 90 percent of EB-5 investors take the Regional Center route to obtain their permanent U.S. residency, so there’s no overstating the impact of how these reforms can instill a heightened sense of security that EB-5 investors deserve.

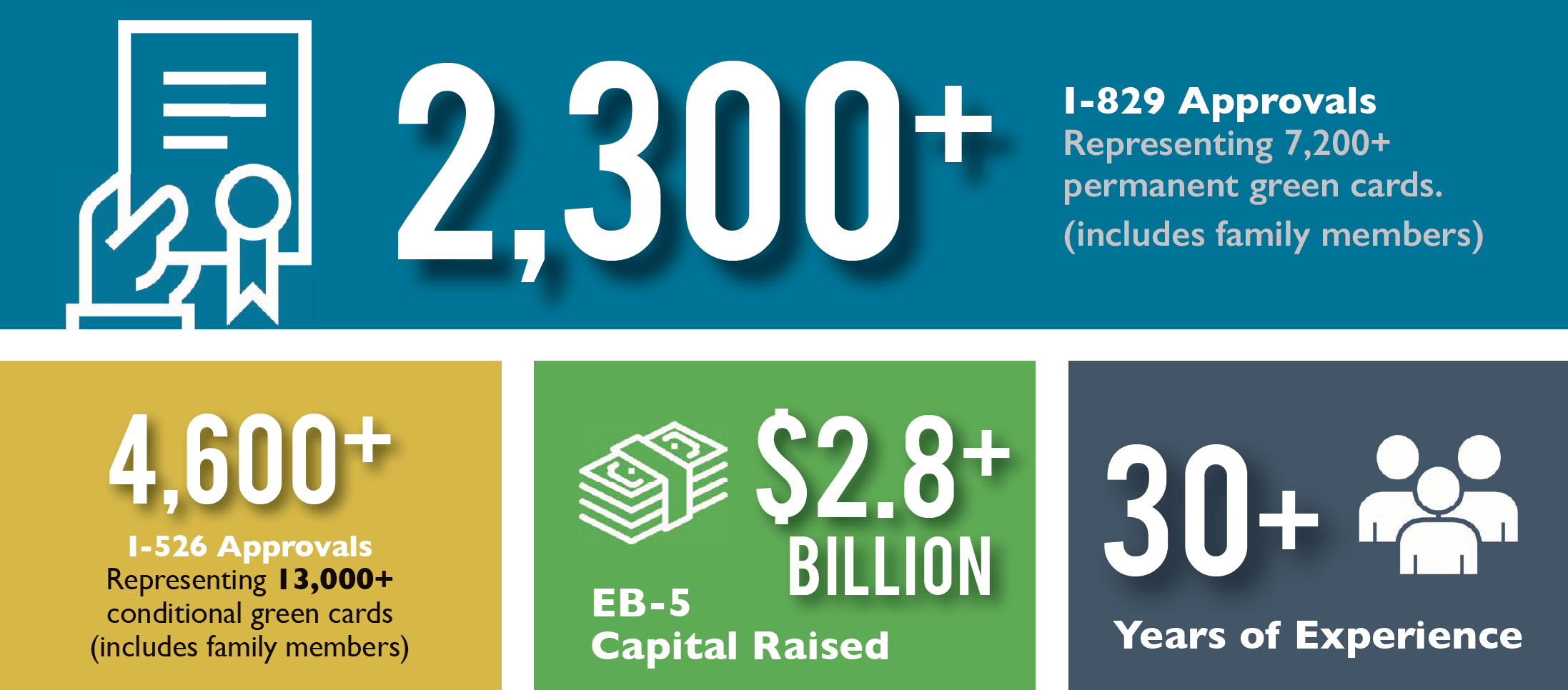

CanAm Enterprises, with over three decades of experience promoting immigration-linked investments in the US and Canada, has a demonstrated track record of success. With over 60 financed projects and $3 billion in raised EB-5 investments, CanAm has earned a reputation for credibility and trust. To date, CanAm has repaid more than $2.26 billion in EB-5 capital from over 4,530 families. CanAm manages several USCIS-designated regional centers that stretch across multiple states. For more information, please visit www.canamenterprises.com.