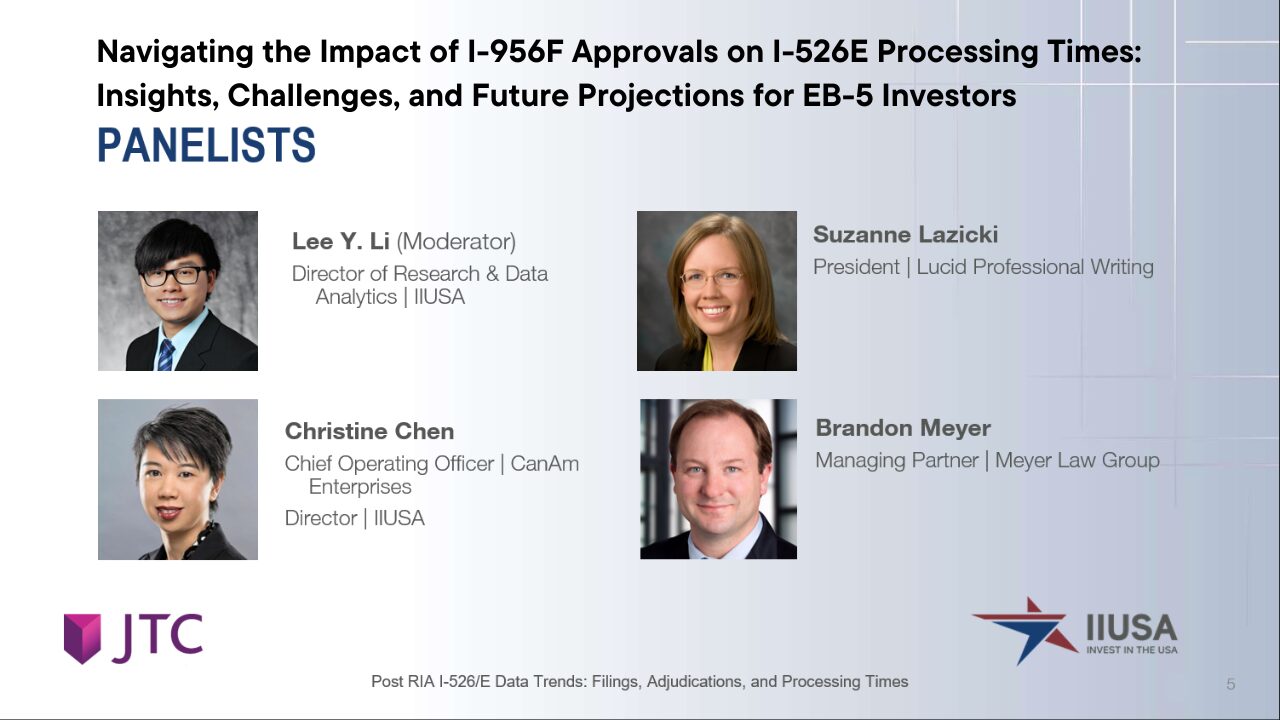

Since the implementation of the EB-5 Reform and Integrity Act of 2022 (RIA), the I-526 and I-526E filing processes have changed significantly. However, one of the biggest challenges remains accessing reliable, real-time data from USCIS. To bridge this gap, Invest in the USA (IIUSA), in collaboration with 11 regional centers and through the Freedom of Information Act (FOIA), collected and analyzed actual I-526E and I-956F processing times. The findings of their analysis were recently published in a comprehensive report, which you can find here.

In conjunction with the release of the report, IIUSA hosted a webinar with industry experts, including CanAm’s Chief Operating Officer, Christine Chen, to discuss latest trends in case filings, adjudications, and processing times in the EB-5 program. As the EB-5 market evolves under the Reform and Integrity Act (RIA), it’s crucial to analyze how these changes are impacting the industry, especially for investors and project developers.

Emerging Market Trends: A Focus on China and India

One of the key takeaways from the webinar was the shifting market dynamics, particularly with respect to the demand from China and India. Historically, these two countries have dominated the EB-5 landscape, and post-RIA, they continue to do so. According to the FOIA data, China accounted for more than 50% of I-526E filings from October 2021 to July 2024, making it the dominant player in the EB-5 space. India, though smaller in volume, remains a crucial market, ranking second.

While the traditional markets like Taiwan and South Korea are showing consistent demand, newer markets such as Brazil and Colombia are also gaining traction. Interestingly, the data revealed that the majority of EB-5 filings from these regions are associated with high unemployment area (HUA) projects. However, there has been a notable uptick in rural project filings from China and India.

Understanding the Influence of Concurrent Filing on Market Behavior

The introduction of concurrent filing with the passage of RIA has been a game-changer for EB-5 investors, especially those from India and China. Concurrent filing allows investors to file their I-526 and I-485 (Adjustment of Status) simultaneously, providing benefits such as the ability to stay in the U.S. while their green card is processed. This provision has made EB-5 a more attractive option for those already residing in the U.S. on student or work visas.

Concurrent filing is affecting investor decisions. The majority of Indian EB-5 investors are now based in the U.S., either as F-1 students or H-1B workers. For these investors, EB-5 is often the only realistic pathway to permanent residency due to the long backlogs in other employment-based visa categories. Similarly, many Chinese investors are opting for EB-5 to expedite their path to permanent residency, given the limited options available through other channels.

The ability to file concurrently has also impacted family size considerations. In the past, it was common for families to file together, leading to higher visa usage per case. Now, many investors are filing individually, particularly for their children studying in the U.S., which has resulted in a decrease in the average family size for EB-5 filings. This shift is likely to reduce the overall demand for EB-5 visas in the short term, delaying the onset of potential visa retrogression.

Analyzing Processing Times and Approval Rates

While the primary focus of the webinar was on filings, the panelists also touched on the trends in adjudication and processing times. According to the data shared, the adjudication rate for post-RIA I-526E cases is still relatively low, with 90% of high unemployment area cases and 80% of rural cases still pending. However, the approval rates are high—93% for high unemployment projects and 96% for rural projects.

These high approval rates are encouraging, but they raise questions about the potential impact of future adjudication waves on visa availability. As more cases move through the system, it will be essential for stakeholders to monitor how processing trends evolve and whether USCIS can maintain these approval rates while keeping pace with the backlog of pending cases.

Conclusion and Future Considerations

The post-RIA data trends reveal a complex yet optimistic picture for the EB-5 program. With strong demand from China and India, increased transparency through data sharing, and the introduction of concurrent filing, the EB-5 industry is poised for growth. However, the challenges of visa availability, potential retrogression, and adjudication delays remain.

IIUSA and its members continue to advocate for reforms that address these issues, such as legislative changes to increase visa caps or separate treatment for derivatives. In the meantime, stakeholders must stay informed and proactive in leveraging available data to navigate the evolving landscape of the EB-5 program effectively.

For investors, understanding these trends can be the key to making informed decisions, while for regional centers, the ability to adapt to these changes will determine their success in the post-RIA EB-5 market.