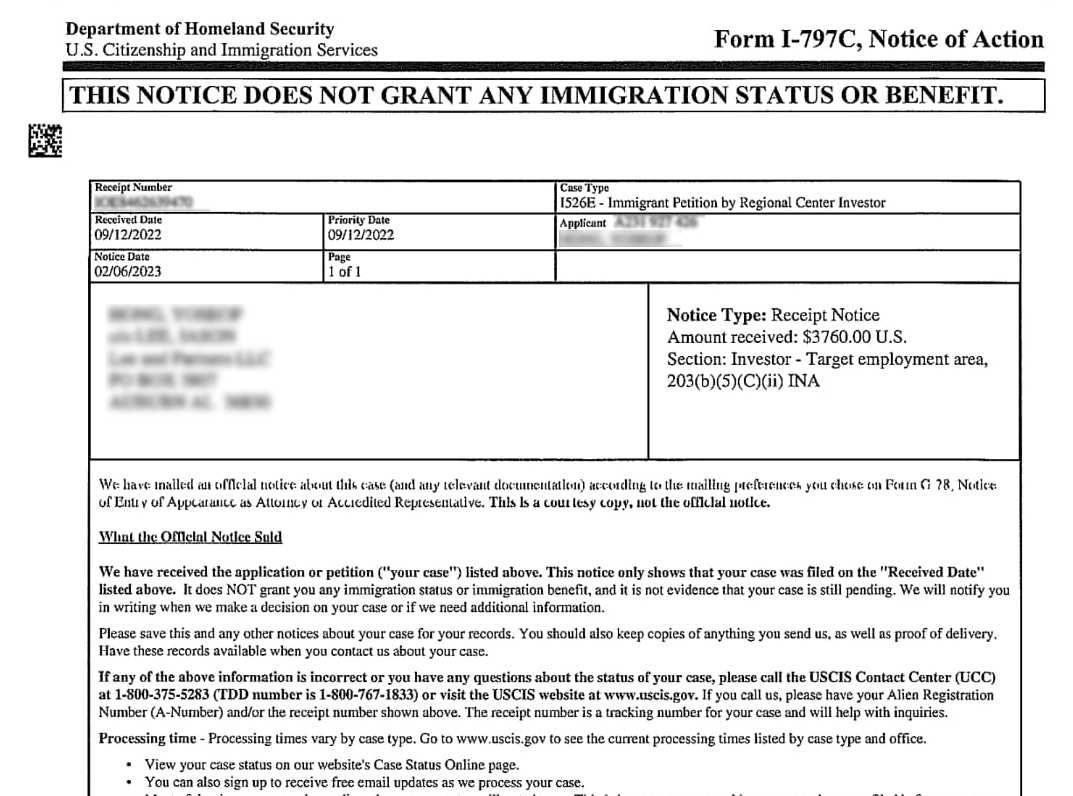

Since the implementation of the EB-5 Reform and Integrity Act of 2022 (RIA), the I-526 and I-526E filing processes have changed significantly. However, one of the biggest challenges remains accessing reliable, real-time data from USCIS. To bridge this gap, Invest in the USA (IIUSA), in collaboration with 11 regional centers and through the Freedom of Information Act (FOIA), collected and analyzed actual I-526E and I-956F processing times. The findings of their analysis were recently published in a comprehensive report, which you can find here.

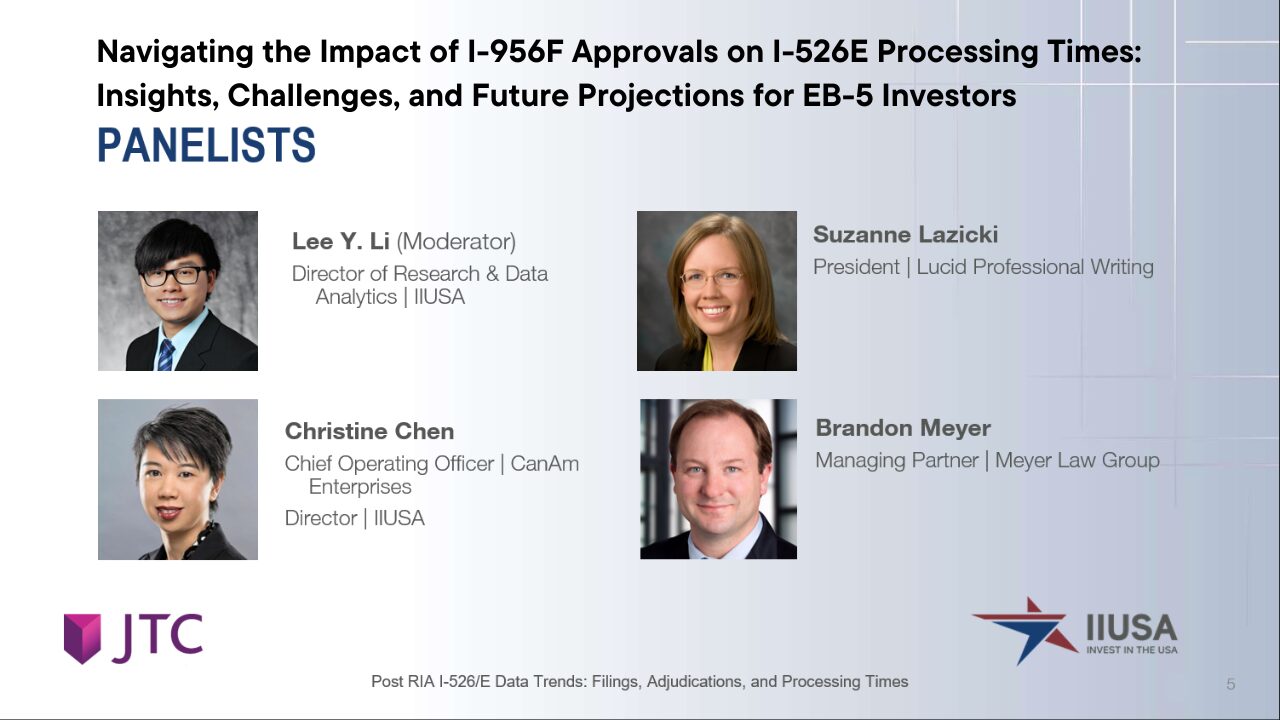

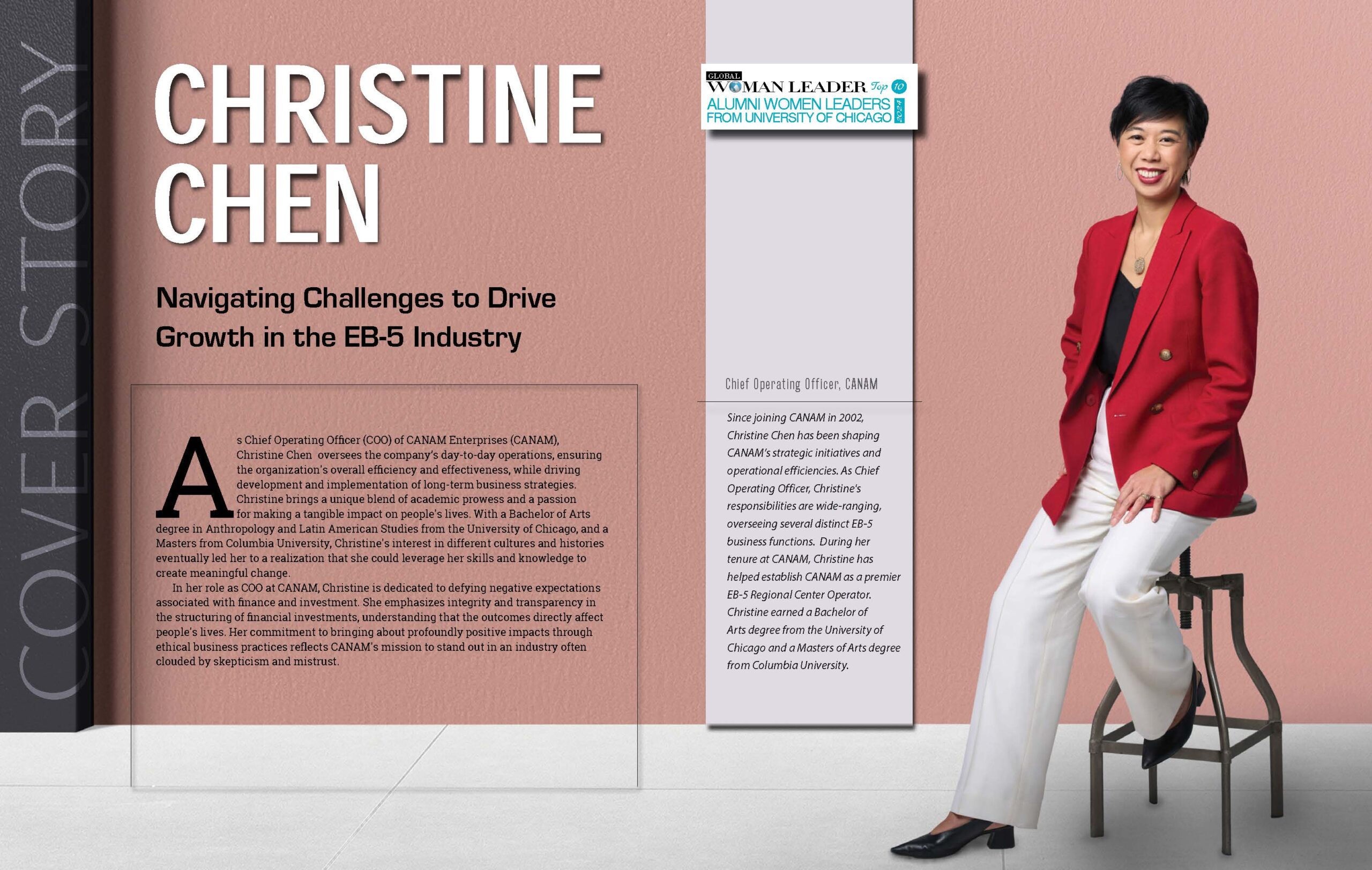

In conjunction with the release of the report, IIUSA hosted a webinar with industry experts, including CanAm’s Chief Operating Officer, Christine Chen, to discuss latest trends in case filings, adjudications, and processing times in the EB-5 program.

LEARN MORE: Post-RIA I-526/E Data Trends: EB-5 Webinar Recording Now Available

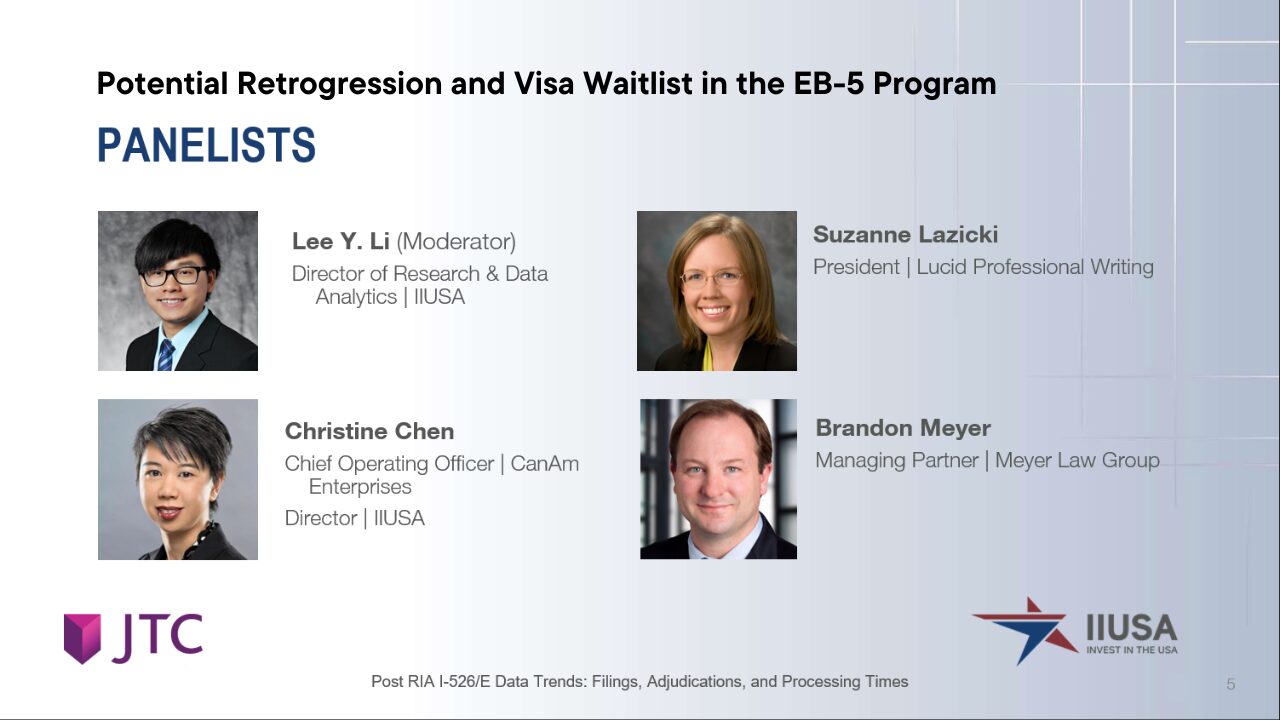

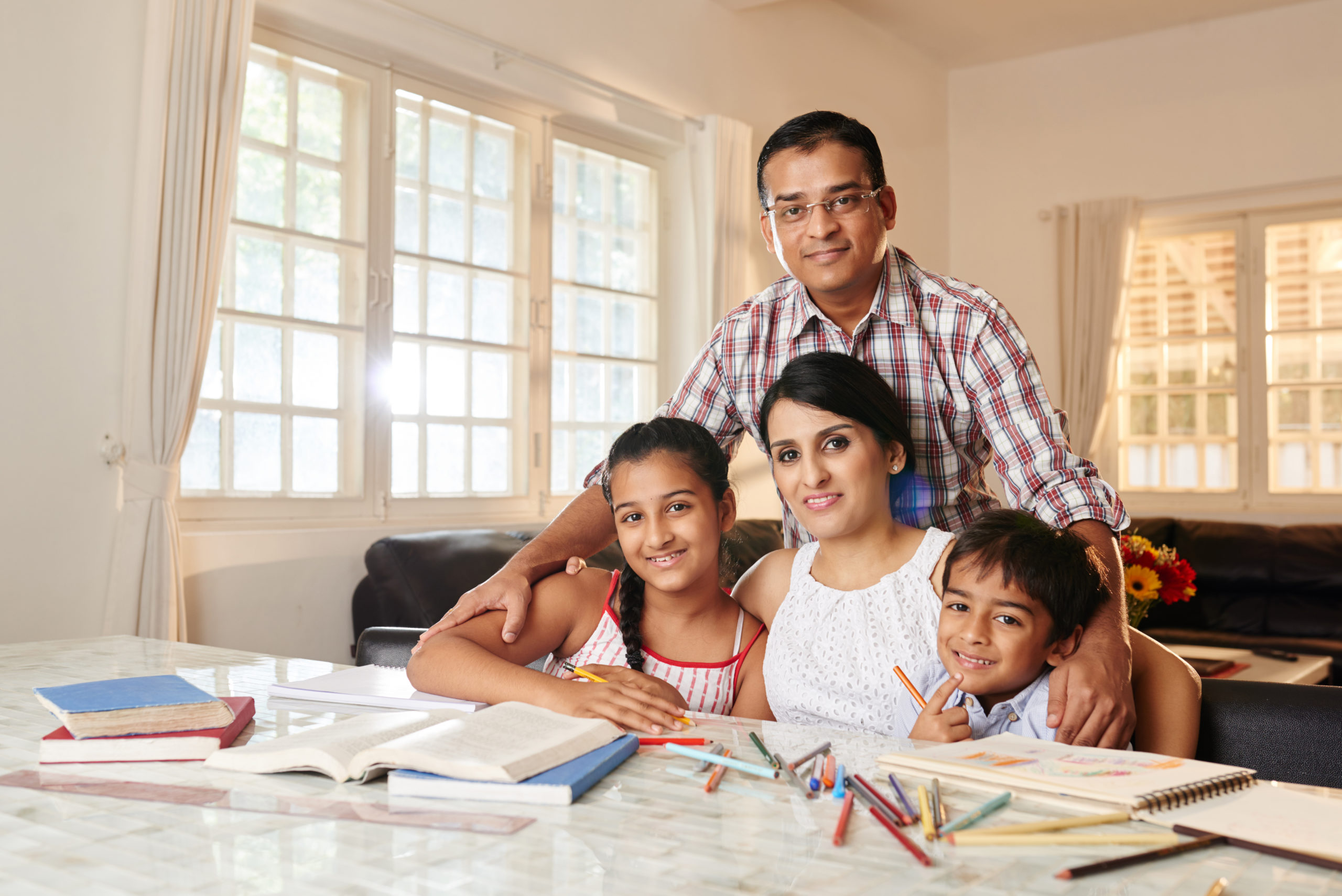

The EB-5 visa program is currently facing potential retrogression due to high demand from China, India, and other countries. Retrogression, which refers to delays in visa issuance, could arise if the demand surpasses the available annual visa allocations. The webinar panelists highlighted that while retrogression may not be an immediate concern in 2025, it could become an issue in the coming years if visa numbers are not expanded.

The data presented shows a robust interest in the program, especially with the introduction of the new set-aside visa categories post-RIA. These categories have attracted more investors, particularly from China and India, looking to expedite their visa applications through rural and high-unemployment area projects. However, with limited visa availability, retrogression may cause significant delays, especially for applicants from high-demand countries.

Advocacy Efforts for Visa Relief and Industry Support

To address these challenges, industry stakeholders and IIUSA are actively advocating for visa relief and legislative changes. Christine Chen emphasized that advocacy efforts are currently focused on two primary areas: securing visa relief and ensuring program stability through legislative support.

IIUSA is working with Congress to promote legislative initiatives like the Dignity Act and the Advisory Committee Act, which aim to introduce visa reforms and improve communication between the industry and USCIS. The organization is also coordinating with regional centers to provide accurate data that demonstrates the economic impact of the EB-5 program, which is vital for engaging with policymakers.

The need for visa relief is more pressing given the current visa allocation and demand. The panelists emphasized that increasing the number of visas or changing the way derivatives are counted could significantly alleviate pressure on the system and reduce the likelihood of retrogression.

Future Market Trends and Potential Program Deadlines

Looking forward, the EB-5 industry is anticipating two major program deadlines: September 30, 2026, and September 30, 2027. The first deadline marks the “grandfathering” cutoff, which ensures that I-526 applications filed before this date are adjudicated under the RIA rules, regardless of future changes. The second is the program’s reauthorization deadline.

These deadlines are expected to drive a surge in applications, particularly from deadline-driven markets like India. The panelists projected that 2025 could see filing volumes similar to 2024, but a dramatic increase is likely in 2026 and 2027 as investors rush to meet the grandfathering and reauthorization deadlines.

While this surge in demand is positive for the program’s visibility and perceived value, it could further exacerbate retrogression issues if visa relief measures are not implemented in time. The panelists recommended that investors consider filing their applications early to avoid the potential backlog that could occur as these deadlines approach.

Conclusion

The future of the EB-5 program remains bright but uncertain due to potential retrogression and pending legislative changes. As the industry gears up for increased demand, advocacy efforts are crucial to ensure that the program remains a viable and attractive option for global investors. By staying informed and engaged, stakeholders can contribute to the long-term stability and success of the EB-5 program, ensuring that it continues to be a reliable path to U.S. residency for investors and their families.